Ask an Investor: Cold Outreach Do’s + Don’ts — IRL Edition

Posted by: Leila Chreiteh

Posted on 10/26/2022

Posted by: Leila Chreiteh

Posted on 10/26/2022

With in-person events returning, investor introductions will require more than the perfect cold outreach email. When you’re face-to-face with a prospective investor, finding the right opening to pitch your vision, convey traction, and make a clear ask is a tall order—especially at large events.

So, we surveyed our network of top-tier investors to see which in-person introduction strategies Do and Don’t work to help you stand out from the crowd.

To make a good first impression, avoid bathroom pitches, interrupting family occasions, or any tactics that border on stalking. Trust us—these tactics are a huge turnoff and only serve to hurt your cause. Instead, look for moments when there’s a natural opportunity for an introduction.

As with all networking, people are more likely to engage with folks they like and want to be helpful to, so a good first impression works in your favor. When in doubt, ask about the investor’s current focus or interests, then see if there’s a good fit between their response and what you’re building as a segue to your pitch.

The smartest founders know their audience and tailor their pitches accordingly. Convincing an investor that your startup fits their portfolio is key to securing a meeting. So, do your research via LinkedIn, Crunchbase, etc., to understand each fund or individual investor’s thesis and past investments to make the case for a perfect fit. The more relevant connection points you can draw, the better.

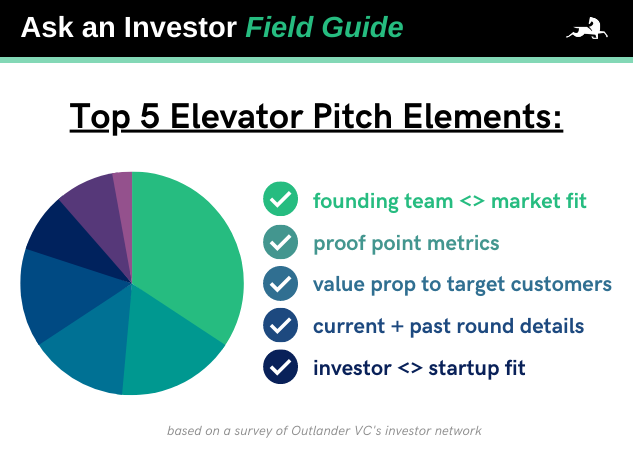

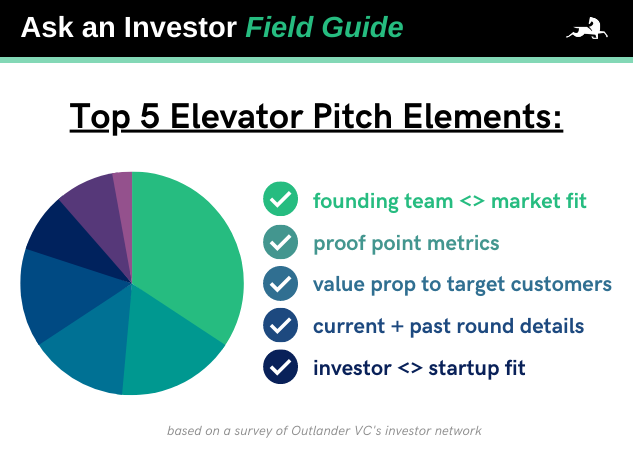

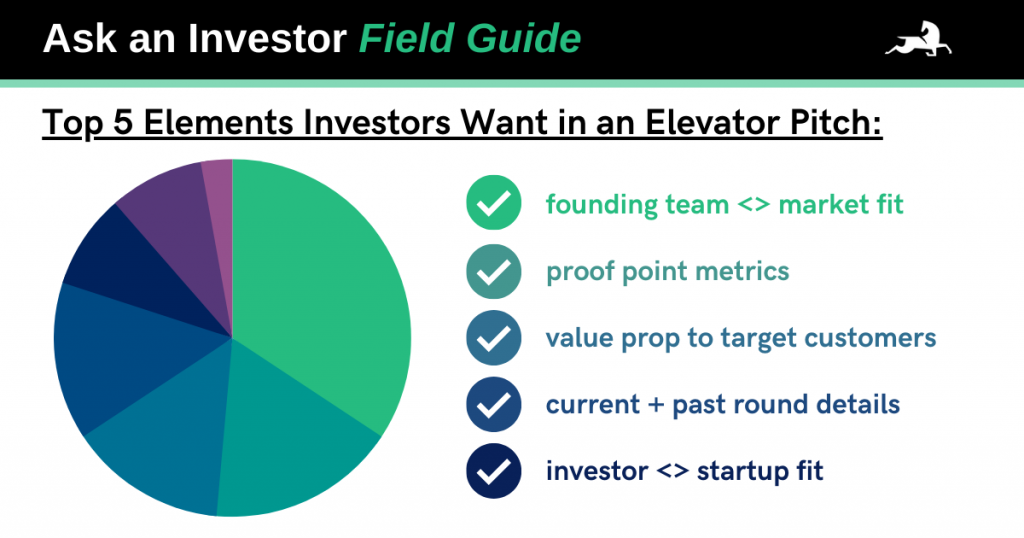

Your elevator pitch should succinctly touch on the scope of the problem, your vision for a solution, your founding team’s unique insight, product-market fit, and the dominant value proposition to your customer or user. Try quantifying your value proposition to further emphasize traction and make your solution tangible, i.e. save x% of time or increase revenue by x%. Explain your solution as it is today and how you predict it will likely develop over the next 3+ years. Once those bases are covered, don’t forget to ask if they have any questions!

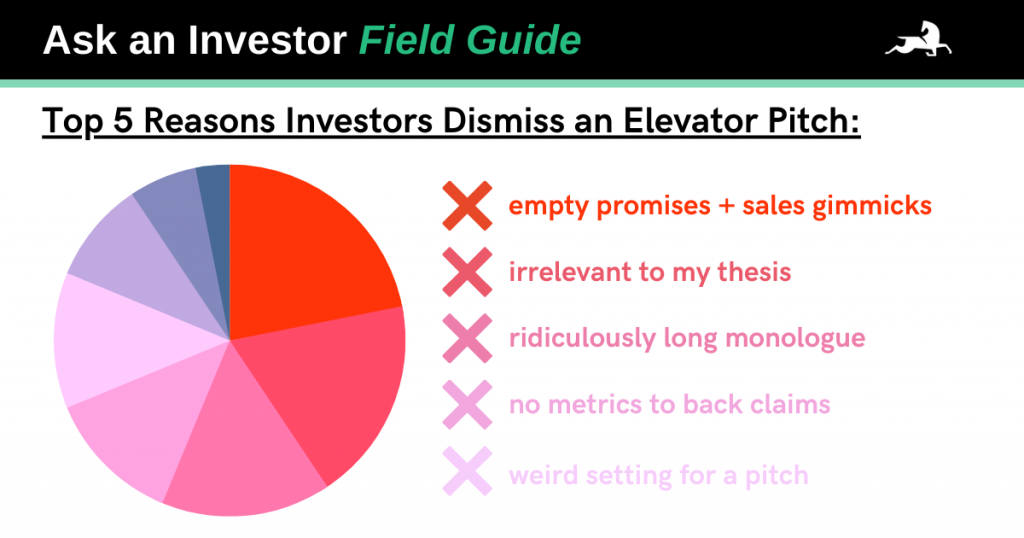

Taking a chance on a founder comes with inherent risk. To mitigate potential wild cards, investors are also screening founders for honesty and transparency. If a founder seems to be withholding or misconstruing information, it’s a pretty big red flag. So stick to what you know.

While you want to appear confident, many investors note that overcompensating in the following ways can quickly kill interest:

Whatever you do, don’t leave an investor wondering, “What is the ask from me right now?” To transition to your ask, share how much you’ve raised to date and any key investors you’ve already lined up. If you’re currently raising, make the terms of the round clear. Be specific in your ask and remember: the worst they can say is no.

To recap, keep these 10 things in mind before you approach a potential investor:

These may seem like a lot of Do’s and Don’ts to juggle, but the bottom line is simple: be clear, concise, and courteous of an investor’s time. Remember that the primary goal of your cold introduction is to pique their interest enough for a call or a meeting, so focus on being straightforward and factual without getting too far down in the weeds.

Next, check out the Ask an Investor: Cold Outreach Do’s + Don’ts Field Guide to craft the perfect follow-up email!

Leila is a communications strategist and tech enthusiast who believes in investing in a better, more progressive future.

As we explore the unknown of each new investment, our Field Guides are where we document all that we learn along the way.

So, whether you’re actively raising, trying to break into VC, or interested in our game-changing portfolio, our Field Guide's got you covered.

Sign up now for exclusive access to funding opportunities, events/resources from our network of experts, updates from our portfolio, and more!