Building a successful startup requires a founder with exceptional vision, intelligence, character, and execution to navigate the inevitable ups and downs. In the Outlander Unicorn Rodeo Series, we sat down with founders Blake Hall of ID.me, Fritz Lanman of Mindbody & ClassPass, Jonathan Neman of sweetgreen, Josh Reeves of Gusto, Matt Pohlson of Omaze, and Waleed Nasr of Medely to dig into the early strategies of these now-unicorns.

Here’s their advice for founders beginning their startup journey:

1. Conviction is the foundation of startup success: First and foremost, only start a company if you can’t imagine not doing it. Startups require immense resilience and sacrifice that can only be justified by a founder with a greater level of conviction. The most successful founders truly understand and deeply resonate with the problem space they’re trying to solve. Compelled by how their vision will change the future for the better, impact-driven founders are more likely to persevere when things inevitably get tough.

“Don’t do it unless you have to do it—unless you’re just so compelled that it’s not a decision.” — Fritz Lanman of Mindbody & ClassPass

“Companies don’t exist for the sake of it. We exist to fix stuff. It all starts with the problem space. It all starts with something being broken and painful, and you’re so compelled to try to fix that thing that you almost have to start a company to fix it because it’s not getting fixed otherwise.” — Josh Reeves of Gusto

2. Build a complementary, mission-driven team: Identify your strengths and weaknesses as a founder, then seek mentors and team members who augment your capabilities. Beyond complementary skills, your core team must share your conviction and be bought into the vision. Invest in a strong relationship foundation with your team, especially co-founders. Company culture can make or break your long-term success, and hiring a people/HR leader early can enable founders to remain focused on product and sales without sacrificing the top-tier talent needed as the company scales.

“The single most important thing for a first-time founder is to get mentors that help you with your blind spots. Be really cognizant of the archetype that you fit into, and build a founding team that complements but doesn’t duplicate your skill set.” — Blake Hall of ID.me

“Hiring as a search for alignment. You don’t convince someone to join, and they don’t convince you to hire them—it’s both parties figuring out, ‘Can we do something great together and having an intentional approach to that?’, whether it’s the values, motivation, skill, alignment approach, or whatever you create.” — Josh Reeves of Gusto

3. Storytelling is an early-stage founder’s most valuable tool: Your ability to sell your vision is crucial for not only fundraising but also hiring, sales, product development, and beyond. Investors invest in the story, not just the numbers—especially in the early days when experienced VCs know not to expect flashy metrics yet. Likewise, storytelling is critical in mobilizing a team around a shared vision. In the early days, there’ll be less capital to offer potential hires, so founders must sell the vision to attract top talent. The best way to craft a compelling pitch is by going out and pitching over and over, A/B testing your way through it. Similarly, get your hands dirty and personally tackle customer support and product testing challenges. This hands-on approach gives you greater insight into your company, helping you lead and fundraise more effectively.

“The most underrated skill set for an entrepreneur—the one that I would argue might be the most valuable, but people invest the least in—is storytelling. Investors use numbers to fortify the story, but they’re investing in the story.” — Matt Pohlson of Omaze

“If you can’t convince a great engineer to come and work for you and build this thing, you’re going to have a really hard time building a successful company.” — Fritz Lanman of Mindbody & ClassPass

“But for growth-stage investors, when you’re coming up to pre-IPO type level, the story matters 25%. Your numbers matter more than anything. Being to being able to tell the story about your numbers became more important than just the story.” — Waleed Nasr of Medely

4. Prioritize everything against your North Star Metric: Have a deep understanding of your metrics from the early days. Prioritize initiatives that scale your core business and contribute to your North Star Metric (NSM). Start small and remain capital-efficient in the early days by focusing on what advances your value proposition. By staying lean and agile, you can prove your business proposition without over-raising capital and, in turn, raising the bar for your next round or exit.

“Think about what that core business is and make sure you’re investing in what your real value proposition is, not some of the other stuff on the periphery.” — Jonathan Neman of sweetgreen

“The military teaches that you always need to lead two levels down. For me, I’m responsible for the profits and losses (P&L). That’s ultimately what I’m accountable for to my investors and the board. So, in order for me to have confidence that my reports are bringing clarity and focus on what matters, they have to show me that they understand how the different things they do tie back to our P&L and then say, based on this, here are the KPIs that are always true.” — Blake Hall of ID.me

Throughout the Outlander Unicorn Rodeo Series, every founder emphasized the importance of vision, resilience, effective team-building, and alignment with the company’s mission as the cornerstones of successful early-stage startups. Without this foundation, it’s easy for founders to lose the forest for the trees. Unsurprisingly, each founder emphasized the need for a North Star Metric to serve as a compass for all aspects of company building.

However, as Fritz Lanman advised, there’s no substitute for a founder getting their hands dirty, which is why hearing fellow founders’ experiences is often more enlightening than generalized advice. So, we invite you to watch the full firesides with Blake Hall of ID.me, Fritz Lanman of Mindbody and ClassPass, Jonathan Neman of sweetgreen, Josh Reeves of Gusto, Matt Pohlson of Omaze, and Waleed Nasr of Medely to soak up all of their expertise, and save your spot for our upcoming events, too!

Founders are the captains of a startup, steering the ship and crew toward their vision of the future. Your relationship with fellow co-captains and the rest of your team will dramatically impact how efficiently and effectively the ship can progress. The stakes are even higher between co-founders, where soured relationships can turn into dissolved cap tables, hefty legal expenses in untangling, or even the company’s failure.

So, we asked the founders of the Outlander Community about their hard-learned lessons in failed co-founder relationships and advice for productively handling co-founder conflicts. Though all agreed conflict is inevitable, keeping the resolution process productive requires the same ingredients as any other relationship: clear expectations, proactive touchpoints, data-driven communication, and support from neutral third parties.

After messily parting ways with co-founders, many surveyed founders’ biggest regret was not catching misaligned expectations until it was too late. These founders were adamant about co-founders delineating their shared vision, values, and expectations before signing any contracts. United by more than money or clout, co-founders who rally around a shared vision, values, and expectations are less likely to implode from infighting.

For example, consider how aligned your answers are to the following questions:

Next, it’s time to codify your agreed-upon responsibilities and conflict resolution process. When conflicts arise, the legal agreements governing your startup will dictate what options are available. From your articles of incorporation to operating and shareholder agreements, these documents outline the rights and responsibilities of each co-founder, ownership stakes, decision-making processes, and dispute-resolution mechanisms. Safeguarding your legal rights and obligations in an operating co-founder agreement is a vital first step for equitable, productive conflict resolution down the line.

While a shared vision can help anchor difficult conversations, it’s just as easy for such aspirations to get lost in day-to-day operations. With so much to juggle, surveyed founders recommend scheduling a routine co-founder meeting specifically to get issues out in the open regularly and addressed as quickly as possible. With frequent opportunities for direct dialogue, co-founders can address issues incrementally instead of letting them sour the working relationship.

For the co-founders of Heartbeat, establishing a standing co-founder dinner ritual has been paramount to preserving their working relationship. Every Thursday, they grab dinner and air out every annoyance, frustration, or problem that needs addressing from the past week. “Knowing we had this time each week ensured there were never any pent-up emotions,” explains Murtaza Bambot. “We got better and better at voicing problems and dealing with them together,” and ultimately, this ritual “created the best working relationship I’ve ever had with anyone.”

A good co-founder dynamic boils down to good communication. By addressing conflicts routinely and directly, you and your co-founder can focus on building your company, not fighting.

With your expectations outlined and routine touchpoints set, resolving conflict productively will boil what you say and how you say it. In difficult conversations, things can quickly become emotionally charged, so it helps to stay anchored in a shared value (i.e., your company’s mission) and lead with the facts.

Using a data-driven approach to solve problems was the most frequent advice from surveyed founders, but with an important caveat: Don’t dismiss emotional responses in pursuing this approach. A co-founder’s emotional response offers valuable insights into their motivations, values, and more. Instead, name the emotions for what they are: a reaction to your interpretation of a situation. And, in the words of Michael Saloio of Huddle, “Conflicts don’t lie inside facts. Conflicts only lie inside our interpretations of those facts. It’s tough to create real solutions when the facts aren’t clear.”

Here’s his fact vs. interpretation framework and how he taught his co founder and team to use it:

Other founders added that as you work to create a new narrative, focus on trying to understand your co-founder’s perspective, not winning the argument. If you hit a wall, pause and take a break from the conversation. When you reconvene, stay solution-oriented by anchoring your difficult conversations in your shared vision and values. Remind each other about what you’re striving toward. Dive back into the problem at hand.

Often, co-founders get so deep in the weeds of a conflict that they can’t see the forest for the trees. That’s why you have mentors, executive teams, and board members: to support your business through issues like a complex co-founder conflict. So, if direct communication proves unproductive, it’s time to bring in a third party.

For example, Renato Villanueva from Parallel suggests role-playing a difficult conversation with a neutral third party. With the unbiased person pretending to be your co-founder, practice delivering your feedback or approaching a conflict, seeing how your pretend co-founder reacts. Try a few different tactics to see which delivery avoids unnecessary escalation. Similarly, bringing a facilitator to help you and your co-founder find a mutually satisfactory resolution. Mediation can be a cost-effective and less adversarial alternative to litigation, preserving the working relationship and potentially avoiding legal battles.

In some cases, co-founder conflicts may reach a point where an amicable resolution seems impossible. At this stage, it is crucial to consult an experienced business attorney before considering any legally binding decisions. A skilled attorney can provide valuable legal advice tailored to your specific situation, such as understanding your legal rights, obligations, and potential remedies, including co-founder exits. However, litigation can be costly, time-consuming, and may harm your startup’s reputation, so it should be your last resort to resolving conflict.

–

Co-founder conflicts can be challenging and emotionally charged, threatening the very foundation of your business. Though conflict is inevitable, the Outlander Community is full of founders who have been exactly where you are now. So, learn from their mistakes and get explicit about expectations, be proactive about co-founder conflict resolution, and don’t wait until conflict impacts the business’s operations to seek third-party support and legal advice to protect your rights and find a resolution.

Lucy Guo’s tech entrepreneurship began as an act of rebellion. After the confiscation of her (admittedly, black market) Pokemon card and pencil profits in second grade, she taught herself coding and marketing and took her talents online. Never one to waste time, Lucy has since cofounded two Outlander VC portfolio companies: Scale AI and Passes. In 2016, Scale AI launched to help companies train, hone, and grow artificial intelligence systems. Since leaving Scale AI, she cofounded venture capital firm Backend Capital and, most recently, launched Passes, a software startup revolutionizing the creator economy with an all-in-one suite of content monetization tools.

“[Creators] are entrepreneurs,” Guo said at this year’s Forbes Under 30 Summit on October 3 in Detroit. “Most creator salaries I’ve seen match those of tech entrepreneurs and engineers. But maybe 10% of the creators are making almost all the money, and everyone else is barely making a living. There needs to be a shift.”

Prior to Scale AI, Lucy was a product designer at Quora and Snapchat. She studied computer science and human computer interaction at Carnegie Mellon but dropped out to pursue the Thiel Fellowship. For fun, she works on random projects (that have been used by 10M+ people around the world), skydives, works out (too much) at Barry’s Bootcamp, and rides electric longboards.

At Outlander VC, we bet on brilliant founders at the earliest stages using our Founder Framework. Outstanding founders like Lucy exhibit strength across the vision, intelligence, character, and execution categories of this framework. We grabbed time on Lucy’s busy calendar to dig into her founder journey and revisit a few reasons we’ve been bullish on her from day 1.

I’ve always been an entrepreneur at heart. When I was younger, I got suspended from kindergarten for selling everything from Pokemon cards to colored pencils at school. But when my parents started taking away those cold cash dollars, I turned to tech. I discovered PayPal and figured, “Okay, cool, this is how I can make money.” So, I taught myself how to code and started making bots and in-game items for gaming sites like RoomScape or NeoPets; then, I learned to build my own websites and make money through ads. So, My Pokemon cards and colored pencils became my virtual arcade game websites and internet marketing tools.

Then, I went to college for computer science and human-computer interactions, but I was actually going to a bunch of hackathons, where I discovered startups. Then, I received the Thiel Fellowship. So, with a few semesters left, I dropped out to start building.

No, my family is pretty risk-averse. My parents didn’t even want me to study engineering because “Women aren’t made for engineering,” so I should study to be a pharmacist instead because that’s what women are better at. All of which is funny because my mom was an electrical engineer! But she would say, “I was the only one in my class. It’s unusual for women to be good at it.” She didn’t believe I could do it because, statistically, it was less likely for women to excel in engineering or tech.

I, on the other hand, always wanted to prove myself. So, when my parents were pissed that I dropped out of college and told me I couldn’t do a startup, I wanted to prove them wrong. I had a chip on my shoulder. When people tell me I can’t do things, I like proving them wrong.

I’ve always been a quick decision-maker because I hate wasting time. Once I gather enough data, I act. You don’t need years of data for every decision. For example, you’ll never regret firing someone too early, but you always regret firing them too late if something’s not working.

This is also why I’ve always been a pivoter. If something’s not working, I take the original idea but change it slightly to test what gets a better product-market fit. Also, I always try to create a bare minimum MVP to ensure I don’t waste too much time in the initial engineering work without feedback from the target audience.

The desire to impact the world and people’s lives is the #1 thing that drives me. A startup can only become valuable if you’ve made a significant impact on people’s lives. You won’t reach unicorn status without improving people’s lives; a startup is one of the best ways to do it.

In the long term, I’ve imagined impacting people’s lives directly by starting a nonprofit targeting human trafficking. But, for one thing, I don’t know how to run a nonprofit, right? On the other hand, I’m good at startups. I’m good at figuring out ideas, building teams, and executing. So I figure I’m better off making money and donating to the best nonprofits. So, by focusing on what I’m good at, I can create a really f*cking big impact on other people’s lives.

An Uber driver mentioned how Paige Craig had coined the term “Silicon Beach” and said I should reach out to him. So, I did via Twitter!

I’ve always liked bouncing ideas off of Paige because he’s invested in so many companies that he’s knowledgeable in almost every space. He’s had his hands in a lot of different early-stage companies across a lot of different verticals. So, we’ve always kept in touch.

I like people who bet on me early and people who bet on me in general. So, when I started working on Passes, I wanted him to be part of the journey again.

Yes! Passes is the best place for fans to connect with their favorite creators.

One of our differentiators is that even though Passes is a Web3 platform, we built it very Web2.5 because we want to be one of the first companies to onboard people onto Web3 easily. We’re one of the new products with good UX where all you have to do is sign up with an email, pay with your credit card, etc., and then the NFT mints into a wallet we create for you.

Passes allow creators to scale one-to-one intimate relationships. I can’t go into our secrets, but most creators make money through pay-to-view and customer-requested content (think: Cameo). Passes lets them take a piece of content and DM it directly to their target audience. So, for example, if I have a segment of CosPlay fans within my audience, Passes lets me send CosPlay-specific content directly to them as a locked, pay-to-view direct message. Direct messages gave a much higher purchase rate than platforms like Patreon, where all the content is available on one feed.

One of our creators was making $515/month on Patreon; on Passes, she is now making $40,000/month. Another creator was making $2.8k/month through Instagram subscriptions, and within 48 hours of using Passes, she’s already made $6,000. So, our tool is helping creators make life-changing money that scales with their fanbase.

Learn more about Passes here.

My short-term goal is to make all our competitors obsolete, and Passes already has more features and is built to be more scalable than most competitors.

Creators are the future. Every creator’s becoming an entrepreneur right now. We are seeing creators starting VC funds, brands, etc., and they’re realizing the value of being an entrepreneur instead of just relying on brand deals, especially with the influence they have over their fans. So, in the long term, Passes is building a suite of tools to help creators become entrepreneurs and build wealth, too. Think about Google’s suite of tools, right? We want to be that suite of tools for creators.

Twitter is a great sales funnel. Generally, I am controversial because I know that’s what gets views and engagement. I think it’s better to be a little polarizing because, especially for hiring/recruiting for an early-stage startup, you can’t compete with the budgets of larger companies. The best engineers are getting paid $500,000 a year in cash. You can’t do that as a startup. People are going to work for you because they want to work for you, right? If you have super fans who are die-hard for you, they will take a huge pay cut to work for you because they believe in you. So, I think it’s much better to be polarizing in that sense. Elon Musk is an excellent example of this, actually. Even while Twitter is like paying pretty poorly, people are at Twitter because they just want to be next to Elon Musk.

Explore all of Outlander VC’s brilliant portfolio companies!

Remote-first startups have quickly become the ecosystem’s new normal. In A16z’s recent survey, 86% of early and late-stage founders said they’re opting for remote/hybrid teams, excited by the potential of a global talent pool and the added flexibility of working from anywhere. With input from some startup veterans and remote work experts, here’s what every founder needs to know to build a happy, high-performing virtual team.

Screen talent for remote-friendly skill sets. Remote work widens your talent pool to anyone, anywhere. However, your team’s happiness and performance rely on your ability to hire talent equipped to excel in a remote environment. Outside of job-related skills, experts suggest hiring talent with above-average communication and organizational skills, tech-savviness, and a self-starter mentality for the best remote team. Posting openings on remote-specific sites like FlexJobs, Remote.co, and Remote OK will also help you attract virtual-ready workers.

Be realistic about time differences. Leading a virtual team includes building trust and camaraderie between people in different time zones. Even though you can hire from anywhere in the world, time zones can get complicated fast. Keeping your team within ~6 time zones makes attending meetings, collaborating, and connecting with their teammates easier on remote-first teams.

Take onboarding seriously. Onboarding is much more than ensuring your new employee has all the necessary equipment to fulfill their role. To set new hires up for success on a virtual team, be sure to include the following in your onboarding process:

To keep your team engaged, create opportunities for impromptu connection. One of the biggest issues with remote-first teams is that it makes informal interactions more complex, resulting in increased social and professional isolation. To keep your team’s morale, collaboration, and creativity high, create virtual alternatives for impromptu, unstructured break room chats. These opportunities to connect can be as simple as adding buffer time to meetings for non-work conversation, adding apps like Donut to your Slack channel, or hosting regular coworking Zoom sessions.

Prioritize working “out loud.” An easy way to avoid siloed workers is to prioritize regular, company-wide updates from every team. To protect everyone’s time, make these updates brief and high-level. Experts suggest weekly highs/lows or holding daily check-ins covering topics like: What did you work on yesterday? What are you working on today? What is blocking your progress? Celebrating small and big wins in a group thread is another great way to keep motivation high!

From recruiting new talent to retaining longtime employees, virtual team management requires a focused and intentional approach to building culture and clear communication. With the right leadership, your remote-first team culture will translate into increased employee engagement and better organizational outcomes. Remember, remote work doesn’t mean working alone—connection matters even more in a virtual environment.

With in-person events returning, investor introductions will require more than the perfect cold outreach email. When you’re face-to-face with a prospective investor, finding the right opening to pitch your vision, convey traction, and make a clear ask is a tall order—especially at large events.

So, we surveyed our network of top-tier investors to see which in-person introduction strategies Do and Don’t work to help you stand out from the crowd.

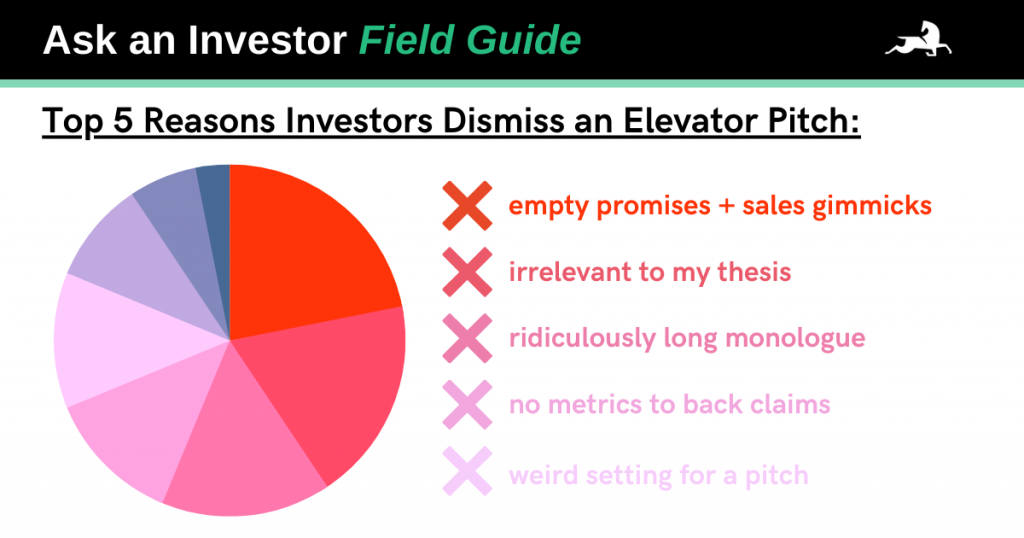

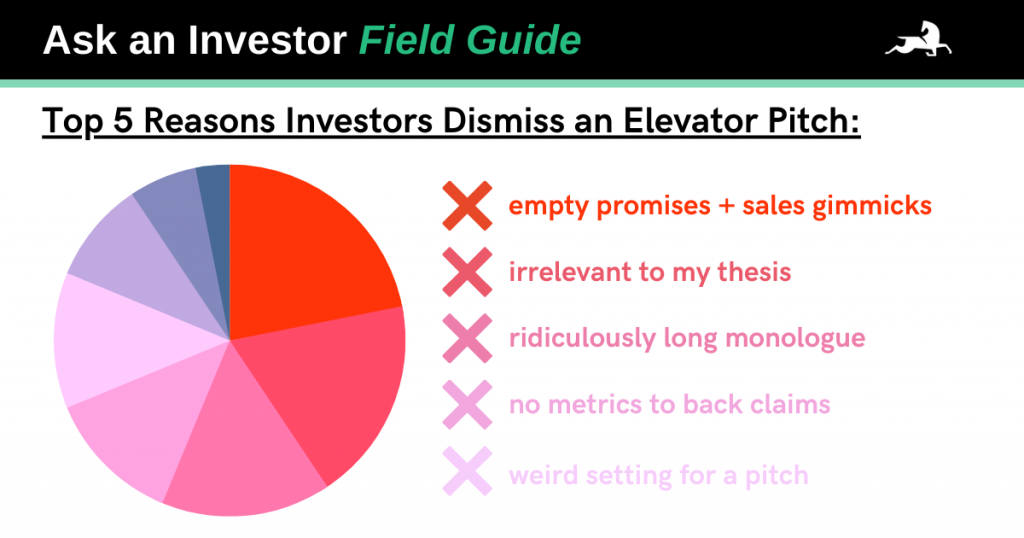

To make a good first impression, avoid bathroom pitches, interrupting family occasions, or any tactics that border on stalking. Trust us—these tactics are a huge turnoff and only serve to hurt your cause. Instead, look for moments when there’s a natural opportunity for an introduction.

As with all networking, people are more likely to engage with folks they like and want to be helpful to, so a good first impression works in your favor. When in doubt, ask about the investor’s current focus or interests, then see if there’s a good fit between their response and what you’re building as a segue to your pitch.

The smartest founders know their audience and tailor their pitches accordingly. Convincing an investor that your startup fits their portfolio is key to securing a meeting. So, do your research via LinkedIn, Crunchbase, etc., to understand each fund or individual investor’s thesis and past investments to make the case for a perfect fit. The more relevant connection points you can draw, the better.

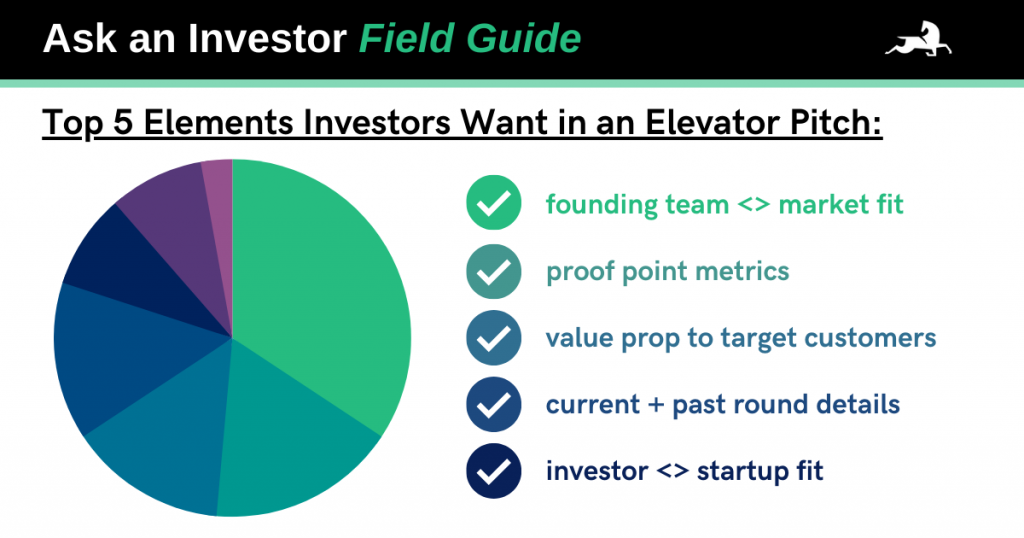

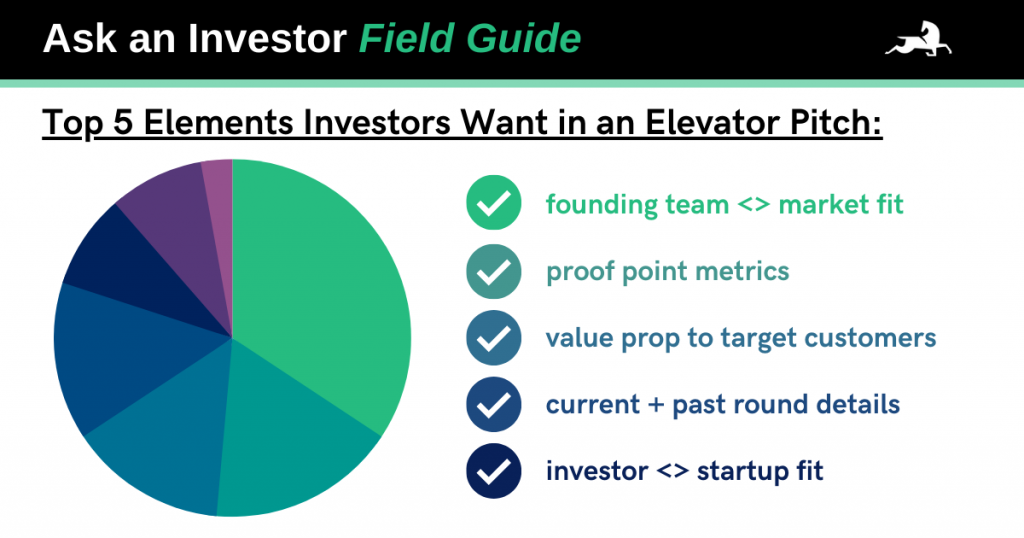

Your elevator pitch should succinctly touch on the scope of the problem, your vision for a solution, your founding team’s unique insight, product-market fit, and the dominant value proposition to your customer or user. Try quantifying your value proposition to further emphasize traction and make your solution tangible, i.e. save x% of time or increase revenue by x%. Explain your solution as it is today and how you predict it will likely develop over the next 3+ years. Once those bases are covered, don’t forget to ask if they have any questions!

Taking a chance on a founder comes with inherent risk. To mitigate potential wild cards, investors are also screening founders for honesty and transparency. If a founder seems to be withholding or misconstruing information, it’s a pretty big red flag. So stick to what you know.

While you want to appear confident, many investors note that overcompensating in the following ways can quickly kill interest:

Whatever you do, don’t leave an investor wondering, “What is the ask from me right now?” To transition to your ask, share how much you’ve raised to date and any key investors you’ve already lined up. If you’re currently raising, make the terms of the round clear. Be specific in your ask and remember: the worst they can say is no.

To recap, keep these 10 things in mind before you approach a potential investor:

These may seem like a lot of Do’s and Don’ts to juggle, but the bottom line is simple: be clear, concise, and courteous of an investor’s time. Remember that the primary goal of your cold introduction is to pique their interest enough for a call or a meeting, so focus on being straightforward and factual without getting too far down in the weeds.

Next, check out the Ask an Investor: Cold Outreach Do’s + Don’ts Field Guide to craft the perfect follow-up email!

As a team of former startup founders, we know how time-consuming raising capital can be, especially for early-stage startups relying heavily on cold intros to investors.

OutPitch 3.1 is how we’re leveling the playing field.

If you’ve got what it takes to outvision, outbrave, outperform, outsmart, and outpitch the competition, start your OutPitch 3.1 application now!

Here’s what founders need to know:

For 14+ years, we’ve honed the ability to write first-checks at the earliest stages of future unicorns, so investors know our finalist picks will be 🔥.

Here’s what investors need to know:

Save your spot now to invest in real-time in five Outlander-vetted startups at OutPitch 3.1:

To learn more about Stonks events, visit Stonks.com. For OutPitch 3.1 questions, reach out to our team at info@outlander.vc.

After a fierce live competition from our five early-stage tech startup finalists, here’s the pitch that won Levantr the title of OutPitch 2.0 Champion:

As the virtual applause faded, we caught up with founder and CEO Jennifer Hong and the OutPitch judges to dig into what this win means for the Levantr team.

Why were you inspired to build Levantr?

I went to an international school for a few years growing up. Most of my friends were ex-pats and diplomats’ kids, so traveling has been a big part of my life since I was young. Because of that, I really believe that seeing new places and meeting people from very different backgrounds makes a person less prejudiced and more intellectually curious. So I wanted to inspire more people to travel farther, explore the unfamiliar and grow from experiences shared with old and new friends.

I’ve organized/planned maybe 50 trips with friends and family and wanted to pull my hair out each time. Planning should be fun. We are the happiest during planning—even more than while traveling—because it’s pure excitement and hope. At Levantr, we want to help and reward people who care about their travel experiences from start to finish, which first means freeing them from endless spreadsheets.

“All of the judges really liked the fact that Levantr’s product has a social hook. Planning a trip is inherently a group activity. Inviting new members to the platform isn’t just a growth hack but a necessary product attribute, which we believe will lead to low user-acquisition costs over time.

We also like that there were many obvious business models that could get spun out of the business. For example, Levantr could develop into an OTA, a media business, or a lead-generation business for touring activities, just to name a few.

In addition to the scalability of Levantr, we agreed that Jen had the appropriate growth background to execute on the vision and build a successful business.”

– Ali Hamed, Coventure and Crossbeam VC

Levantr, in its current form, is a productivity tool for travel coordination. As such, we get a behind-the-scenes look at our users’ travel plans—their dream flights, hotels, excursions, eateries, and so on—and key insights into how they’re making their travel decisions, allowing us to a powerful personalization engine for travelers.

We’re essentially creating a new kind of decentralized, demand-driven marketplace for travelers with personalized deals and inter-user inspiration. Looking forward, we believe Levantr will become the ultimate marketing channel and marketplace for all types of travel providers and complementary businesses, such as hotels, tour operators, travel agencies, influencers, ancillary services, the hospitality industry, and even OTAs. We’re thrilled to kick this journey off with our partners at Shanti Global Hospitality, which includes 30+ hotels and travel brands, and the upcoming pilot marketplace featuring international hotel partners Nira Caledonia, Shanti Maurice, and more!

At Outlander, we believe strong founders are the primary determinant of successful companies.

With Levantr, I was super impressed with Jen’s background and how it has informed her thinking in building out the Levantr marketplace model. Throughout her pitch, she demonstrated a strong understanding—and many first-hand experiences—of travelers exasperated by trying to coordinate and organize group itineraries.

And although Levantr is a very early-stage company, Jen’s smart, early execution and intelligence around which pieces of her company to prioritize initially makes me believe she’s got what it takes to build something big.

We’re super excited to welcome Jen to the Outlander family!

– Leura Craig, Outlander VC

Why do you want to work with Outlander VC?

When we started looking for early-stage investors, Outlander VC came highly recommended again and again. As an early-stage company creating an entirely new business model, we knew we needed investors who understand how to support an early-stage founding team and add value to our growth. For us, that’s Outlander VC.

What drew you to OutPitch 2.0?

Funnily enough, I actually attended the first OutPitch! I remember thinking it would be such a great opportunity for Levantr, so I immediately messaged them about the next one on Twitter. A few months later, we applied as soon as it opened.

To now win OutPitch 2.0 is surreal. We had just begun our fundraising journey, so winning this pitch competition strengthens our conviction that Levantr can help the industry. The whole experience and the Outlander VC team’s excitement have made us more energized and motivated to tackle the next hurdles and accelerate our growth!

________________________________________________________________________________________________

Thank you again to all five of our OutPitch 2.0 finalists, who made our judges’ decision incredibly difficult by representing the most innovative early-stage tech startups across the US.

Watch each finalists’ live pitch and Q&A here:

Until next time, keep hunting and stay outlandish!

First impressions matter—especially when you’re making a cold introduction to a potential investor. And in order to make sure you put your best foot forward as a founder, you must broaden your scope from merely raising funds to building lasting relationships.

We surveyed our network of pre-seed investors to determine what elements of a cold outreach are most likely to work in a founder’s favor and what aspects of a cold intro compel them to immediately delete. Here’s what they shared with us:

These may seem like a lot of Do’s and Don’ts, but the bottom line is simple: be clear, concise, and courteous of an investor’s time. Remember that the primary goal of your cold introduction is to pique their interest enough for a call or meeting, so focus on being straightforward and factual without getting too in the weeds. Finally, if you want to grab their attention, do your research and personalize your pitch!

For more expert advice on building and scaling your startup, check out our event library and Field Notes.

Alex is the CEO and Founder of AC Consulting Group, a recruiting firm specializing in scaling early-stage venture-backed startups. He works directly with founders and functional leaders to fill their highest priority roles with the highest-quality talent in tech. Through his hundreds of hires for many dozens of tech startups via AC Consulting, Alex has seen just about every recruiting scenario a startup might find itself going through.

Though most of Alex’s clients are Seed and Series A, he’s successfully worked with clients ranging from late-stage growth companies down to building Pre-Seed companies from scratch. His hires range from just about anything you can imagine an early-stage company would need— including non-tech roles like Head of Recruiting, VP Sales, VP Marketing, and many more—with a primary focus in engineering and product recruitment.

I’ve spent a lot of time in the early-stage recruiting space and have had the pleasure of working with some fantastic VCs and founders. The way I look at it is the future Zuckerberg’s and Musk’s are in this tech space, and I’m a huge believer and investor in technology because, of course, it’s the future. But focusing almost exclusively on early-stage startups’ recruitment comes with a unique set of challenges.

First, it is extremely difficult for an early-stage startup with minimal notoriety to get responses to job postings. Second, a growing number of professionals—especially in the technical realm—just don’t reply to recruiters. Instead, they want to hear directly from the startup’s founder, which leads us to the third challenge: recruitment is a full-time, specialized job that founders do not have time for.

And that’s where I come in. Using a dummy founder email address, I’m able to execute recruitment marketing campaigns to source and filter through candidates on behalf of the founder. Then, founding teams meet with the top candidates and—more often than not—invites them to join their early-stage team. Since I began recruiting this way, I’ve iterated and perfected my early-stage recruitment funnel method.

For candidates with a background in startups, I’d ask, “What is the best example of a time when you single-handedly changed the trajectory of a company that you work for?” and then push them for excruciating detail. They should be able to explain the impact top-down—a good executive person would understand their impact on everyone’s roles all the way down the line in low-level detail.

For candidates without a background in startups, the first question may be less relevant. So instead, I’d ask them, “What was the most impactful thing you’ve done in your previous roles?” and then push them for the same level of detail as the first question.

In whatever way makes the most sense, dig into their previous experiences to learn what size/kind of impact they’ve made in their previous roles, how they did it, who helped them get there, and, ultimately, will they be able to recreate that impact? Will they be able to tackle major challenges, implement a plan, and then execute on it? Are they willing to roll up their sleeves? Do they need a team? You need to get a sense of how they functioned in previous roles and whether that function makes sense in the context of your company.

In my opinion, you should give equity to everybody on your team. Even if it is just a few shares, it will make them feel bought into the startup’s success. As far as how much you give, that really depends on your valuation and the market value of the employee, i.e. their position and value-add to the company.

People will retain themselves if your company does well, so treat your current employees well and hire good people around them. From a recruiting perspective, treating your team well means avoiding any stagnation of headcount and losing good team members unnecessarily. I always say, “Losing people based on compensation is very expensive.” If somebody wants $10K, $15K, or $20K more, and that makes you a little uncomfortable, trust me when I say that the people who work at your company want to see that potential for growth within the company. So paying current employees a little bit more to retain them will help you in the long run.

So treat your current employees well, give refreshers, give raises, and grow your company!

I highly suggest building remote teams. The concentration of tech folks in the San Francisco market versus the next market down—such as New York, Seattle—and sub-markets like Austin, Denver, Portland, Boston, etc. is night and day. Plus, with remote learning becoming more and more accessible, the perfect fit could literally be anywhere. If you want to scale a technical startup, you need to look outside your local geo and figure out how to incentivize top-tier employees from top-tier markets.

I’m a little bit biased, but my advice would be to hire outside help to recruit from these markets. Beyond that, I’d suggest leverage your network—and especially your VCs networks—to find candidates from outside your geo that are worth the investment of recruiting and converting to hires.

Find hustlers. Find somebody willing to grind and who is sharp and capable and has a chip on their shoulder. Somebody who is a little money motivated because, for inside sales, they’re going to need to be. In my opinion, try to hire someone right out of school who cares about growth and being the best at what they do. Hop on LinkedIn and shoot out some messages, then it should be easy to find folks who fit this personality.

It’s the same as recruiting anybody, but you need to spend a lot more time with them. Generally, the more senior the position, the more acceptable it is to have a more prolonged and intensive interview process. The standard interview process doesn’t apply to co-founder recruitment because you need to spend way more time with them and really get to know them. For example, my former co-founder spent like 20+ hours walking around the park and doing all kinds of stuff to get to know me better. This is the person who will be co-running your startup, aka your baby, with you, so you need to spend a lot of time getting to know them as a person before pulling the trigger. Ideally, you should probably consider potential co-founders that either you already know super well or someone you know and trust also knows and trusts them, too.

For more expert advice on building and scaling your startup, check out our event library and Field Notes.

A startup’s early momentum relies not only on the founding team’s outlandish vision but also on how effectively that mission is articulated in its external business strategy. From the tone of your messaging to how you visually display your solution, every contact point you have with potential investors and customers creates the overarching narrative that influences how they perceive your brand.

Building a great brand narrative starts with nailing down the top 2 to 3 values you want to convey and the belief that echoes these values: What belief is your mission built upon? Why do you care about it so much? How will your startup deliver on its promise? These are the impressions you want your audience to take away from your collective marketing efforts.

Like your startup, these branding attributes may eventually need to pivot. In fact, pivoting your business may necessitate a brand refresh to remain true to your mission. However, rebranding is not a decision to be made frequently or flippantly. A poorly timed rebrand will cause logistical challenges that end in losing brand recognition, breaking web assets, and confusing existing customers. But if your brand narrative no longer aligns with your mission, then rebranding becomes necessary for your marketing to remain effective.

For one of our portfolio founders—Akshita Iyer of Ome—the decision to rebrand her early-stage startup felt inevitable:

In the aftermath of her mother’s kitchen fire in 2016, Akshita Iyer set out to create a solution to help other families avoid a similar tragedy. Her team developed a smart knob for gas and electric stoves that turns them into smart appliances within seconds. By syncing directly to your smartphone, the smart knobs give you total control of your stove from anywhere.

The first iteration of Iyer’s startup was called Inirv, which pulled from the medical term “innervate” and describes how nerves connect different parts of the body and allow them to communicate with one another. The name reflected the technical aspects of her startup’s solution, but as Akshita began pivoting to a consumer-facing market, she knew that something was off:

Realizing she was at a pivotal moment just before mass production of their inaugural product and rebranding would become a logistical nightmare, Akshita decided to pull the trigger on a new name and look. However, she quickly began to worry over finding the right name and aesthetic for her venture. So, back at the drawing board again, she reached out to our very own Leura Craig here at Outlander and asked whether she should seek out a marketing agency that could approach the project with a fresh perspective.

Leura shared two crucial pieces of advice with Akshita:

Akshita took two weeks to make a list of dozens of words that came to mind when thinking about peace of mind, safety, cooking, or simplicity. Her team even dug up some names from the past to re-evaluate their potential. Unfortunately, like many early-stage startups, they repeatedly ran into trademarking roadblocks because major appliance brands had gobbled up so many of the terms they came up with. Additionally, Leura reminded them that they also needed to be able to acquire a strong domain. Eventually, Akshita went so far as to send out a mass text to her friends and family members asking them to send her any word they could think of that might be connected to the company in some way.

In response to Akshita’s all-call for branding ideas, her sister-in-law sent the word “OM,” as in the sound that’s frequently used in meditative practices. Akshita thought it was interesting because of its connection with a sense of peace and serenity, which her venture’s products aimed to bring to consumers. Still, she worried it was already too heavily associated with other things, like yoga and meditation practices. But after reaching several other deadends, she looped back around to it and started to consider how it might be able to work.

And so Ome was born.

From there, Akshita turned her attention to the look of the brand, which had initially been envisioned to feel very “techie” in nature with its sharp font and bright blue gradient.

She realized that the visuals weren’t matching the feeling they wanted their company to convey, which was a sense of calmness. So her team shifted to soft, curved, and lowercase lettering and incorporated gradient colors going from blue to purple. They even managed to make the O in Ome a subtle nod to their first product: a circular, smart stove knob.

For Akshita, the brand instantly became warmer and more understandable. Consumers didn’t need to know all the technical details behind the product to benefit from it; they just needed to get a sense of what their experience would be like owning the product: simple and worry-free. So they continued to build out their messaging using the new name and a focus on value their product brings to consumers—ease, simplicity, and peace—and purposefully avoided aesthetics and messaging reliant on fear-mongering.

In the end, it was Akshita who gained some peace of mind about her company’s future and its message to the public. Previously, she’d struggled to envision Inirv becoming a household staple name. But with Ome, the pieces finally started to fit together for her startup to take the next big step. Not to mention, it renewed her confidence in the mission she set out on several years ago.

Her advice for fellow startup founders considering a rebrand? Go with your gut:

You’ve probably heard the phrase “Branding is everything,” and it is without a doubt a pivotal part of the startup journey. But rebranding choices aren’t to be made frequently or flippantly. Akshita’s team chose the right moment, avoided major trademark and domain pitfalls, and ensured they stayed true to their overall mission and narrative. In short, they utilized their rebrand to speak to their potential customers with a clearer and more compelling message that will ultimately lead to greater success for their brand.