The Truth about Raising Money on AngelList

Posted by: Team Outlander

Posted on 08/27/2015

Posted by: Team Outlander

Posted on 08/27/2015

To explain why our team here at Arena is so bullish on crowdfunding that we tied our model to it, I find it helpful to draw an analogy to another trend I’m passionate about: online education.

The early wave of online degrees and online universities created a stigma around online learning – people associated online degrees with a low bar for quality/prestige and with several well-known for-profit universities who didn’t have students’ best interests at heart. But the educational potential of learning online is extraordinary: data and machine learning improve students’ education in real-time and give professors magnitudes more information with which to improve courses. It can enable top universities – freed from the constraints of physical buildings – to scale their educational experience to everyone who qualifies (anywhere around the world) on a model that actually gets better the more students it includes (thanks to the amassed data).

The first startup I worked for out of college was 2U, Inc., an edtech company that is powering full online master’s degrees for top universities (Yale, Berkeley, Georgetown, USC, etc.). 2U has spearheaded the model of online higher ed that lives up to its true potential and empowers tens of thousands of students. Rather than being third-tier students, the students learning online via their platforms are full equals to peers on campus, with student IDs, campus gym access, 12-student average class size, student organizations, and class gifts to the university when they graduate. Their admissions criteria, learning outcomes, and job placement outcomes match or beat the statistics for on-campus students in the same degree programs.

Over the last couple years, crowdfunding has been making a similar shift from its early incarnations – which were not without some challenges – into a robust ecosystem capable of providing just as much value to entrepreneurs as the best alternative options (offline VC deals). While there weren’t the scandals that the education sector had to navigate, the early days of crowdfunding did raise valid concerns amongst entrepreneurs and investors. One of the biggest concerns was negative signaling associated with crowdfunding: “only people who couldn’t raise money from real investors would try this weird new crowdfunding thing”. There was a self-selection bias among the startups on the platform and the novice investors who participated – they were often participating online because they couldn’t access capital (or for investors, couldn’t access deals) elsewhere. While there were certainly exceptions – Naval Ravikant did bring other notable angels in to participate in some AngelList deals – there were systemic challenges that made crowdfunding unappealing to startups who had other funding options.

Crowdfunding campaigns, similar to Kickstarter campaigns in how they were run, took a lot of time away from the entrepreneur’s focus on running their business: campaigns necessitated cold messaging dozens (or hundreds) of random investors’ profiles, hoping their company’s profile page would “trend” and be featured on the homepage if enough investors took interest. And for all that work, a startup would get very little value from investors in return aside from the money itself. As tech investors know, money has become a commodity and the bare minimum to get into good early stage deals is to bring something else to the table that will help companies further. The challenge with a crowdfunding campaign was that not all of the participating angels offered additional value and those who did usually didn’t have a big enough ownership stake to roll up their sleeves and invest additional time/relationships into the company.

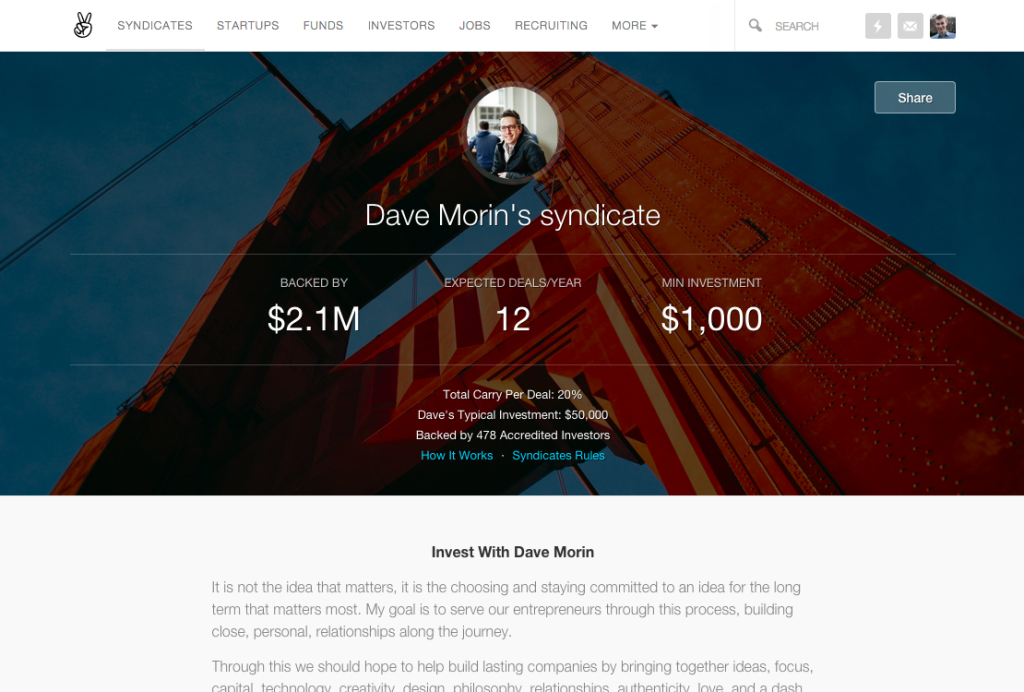

But like new models developed to bring online education into a new era, we are now in a whole new stage of crowdfunding’s evolution. There is zero question in my mind that crowdfunding in 2015 can be just as effective for entrepreneurs (and even more so) than the standard model of venture capital and angel investing. The tipping point was the launch of “syndicates” on AngelList – and now similar models on other crowdfunding platforms like Quire. Syndicates are like angel groups led by one lead investor who spearheads the sourcing and managing of deals in exchange for carry (15-20%, plus AngelList’s 5%) from the other angels who then participate with him or her. The syndicate invests in the startup as one entity and the lead investor (“syndicate lead”) acts as the one liaison, both for paperwork and for leveraging the group’s resources to help the startup with introductions, industry expertise, etc.

The syndicate model incentivizes strong investors to spearhead crowdfunding. Early hype around crowdfunding professed that online platforms would replace VC firms and professional angel investors, but that couldn’t be farther from the truth. Exceptional entrepreneurs will always want to work with exceptional investors who can help accelerate their business, and since startup investing is a “hits business,” any investor who want to see a return on their money needs to invest in the exceptional entrepreneurs. The path then for many angels is to participate in the deals of their most capable peers. Syndicates financially incentivize (on a performance basis) top investors to include others in their deals, and enable that lead investor to write much bigger checks than they alone can afford to.

Which leads me to a second critical point: good syndicate leads are bringing access to top deals that weren’t going to be on crowdfunding sites otherwise – that’s why backers are willing to pay carry (much like traditional VC Limited Partners would) to participate in deals they source. When top angels and VCs find a startup they believe can become a massive company, they inevitably want to get a large stake in it – incorporating an AngelList syndicate into their investment allows them to do that (instead of a $50,000 check they can invest $500,000 with 20% carry on the $450,000 others contributed). This creates a best of both worlds: entrepreneurs get to work with a top investor who is heavily invested in their success, and backers of the syndicate get to access deals they otherwise wouldn’t see. The entrepreneur can always tap into the contacts and experience of angels in the syndicate if they want to (part of crowdfunding’s promise) but without an obligation to interact with them if they don’t want to.

Crowdfunding syndicates aren’t displacing capable investors, they’re displacing traditional Limited Partners. For a top tier angel investor who wants to graduate into bigger checks and into leading seed rounds, the natural next step has been to raise a 10-year VC fund (with capital from family offices, endowments, and major financial institutions) – look at the rise of “micro-VC” firms. But AngelList syndicates are becoming a more flexible alternative to raising a fund: the platform handles most of the paperwork and the investor only has to do deals when they want to, incorporating the backers they want to have involved in that specific deal. Moreover, AngelList is an increasingly comprehensive financial ecosystem including multiple large fund-of-funds backing the leading syndicates in a similar way to how traditional fund-of-funds back VC firms, and including increasingly large and complex deals (like secondary investments into growth stage companies).

At Arena, we’ve built a hybrid model because it gives more flexibility to our check sizes and gives us a pool of several hundred angels from diverse background who we can tap to provide additional value-add to portfolio companies. We don’t operate our fund and our AngelList syndicate as separate firms – they are locked together and we always invest from both (which ensures neither fund LPs nor syndicate backers are ever pushed out of a great deal). For an entrepreneur, it’s just Arena investing – the fact that our capital comes from two sources doesn’t have to be any different than when a traditional VC firm invests using two funds (some remaining capital from an old fund, plus capital from their new fund). Numerous other VC firms have started incorporating crowdfunding into their investments as well, from Slow Ventures and Rothenberg Ventures on AngelList to betaworks and Index Ventures on Quire, and I’d expect numerous more to do so over the next two years.

Having to publicly share extensive internal metrics on their traction was also an early deterrent to top startups from running crowdfunding campaigns in the past, but many of the deals that syndicates do nowadays aren’t made publicly visible to all investors on AngelList. They are only made visible to approved backers of the syndicate. The syndicate lead can determine with the entrepreneur what information about the startup’s traction should and should not be shared with that group. Plus syndicates led by well-known investors – while they should always provide as much transparency to backers as possible – benefit from having a lead investor whose judgement and due diligence backers trust enough to still invest even if he/she can’t reveal much info at the request of the founder. Syndicates can even be run on an invite-only basis to control information further in the most extreme circumstances.

Crowdfunding has evolved substantially over the last half-decade and the model of AngelList syndicates has enabled it to at last go mainstream among top tier investors (and provide exceptional value to the startups and angels involved). The ecosystem to support syndicates – and the streamlined process for conducting them – becomes more robust each quarter. Over $100MM was invested over AngelList alone in 2014, and if their growth rates continue at the same pace it will be many times that within just the next couple years. The revolutionary impact of crowdfunding won’t be that it replaces professional investors, it will be that it scales the act of investing in startups and provides access to anyone around the world (who qualifies) to invest alongside the top professionals. For entrepreneurs, that’s an ideal situation: the full involvement of the same “superangels” and venture capital firms we respect now, augmented by the option to tap into an additional network of angels who are eager to help your startup if they can.

Whether you’re actively raising, building your future unicorn, or interested in our game-changing companies, each Field Guide is personalized for founders and investors alike.

Sign up now for exclusive access to our network of industry experts and to keep up with who we’re funding through our biggest and boldest endeavors to date.

You don’t want to miss the game-changing ideas we’re morphing

into reality, in real time.

Join the Outlander pack for exclusive access to our network of industry experts, the latest from our portfolio, and more: