Four Takeaways for Startup Founders from Inspired Capital’s Alexa Von Tobel

Posted by: AJ Smith

Posted on 11/19/2024

Posted by: AJ Smith

Posted on 11/19/2024

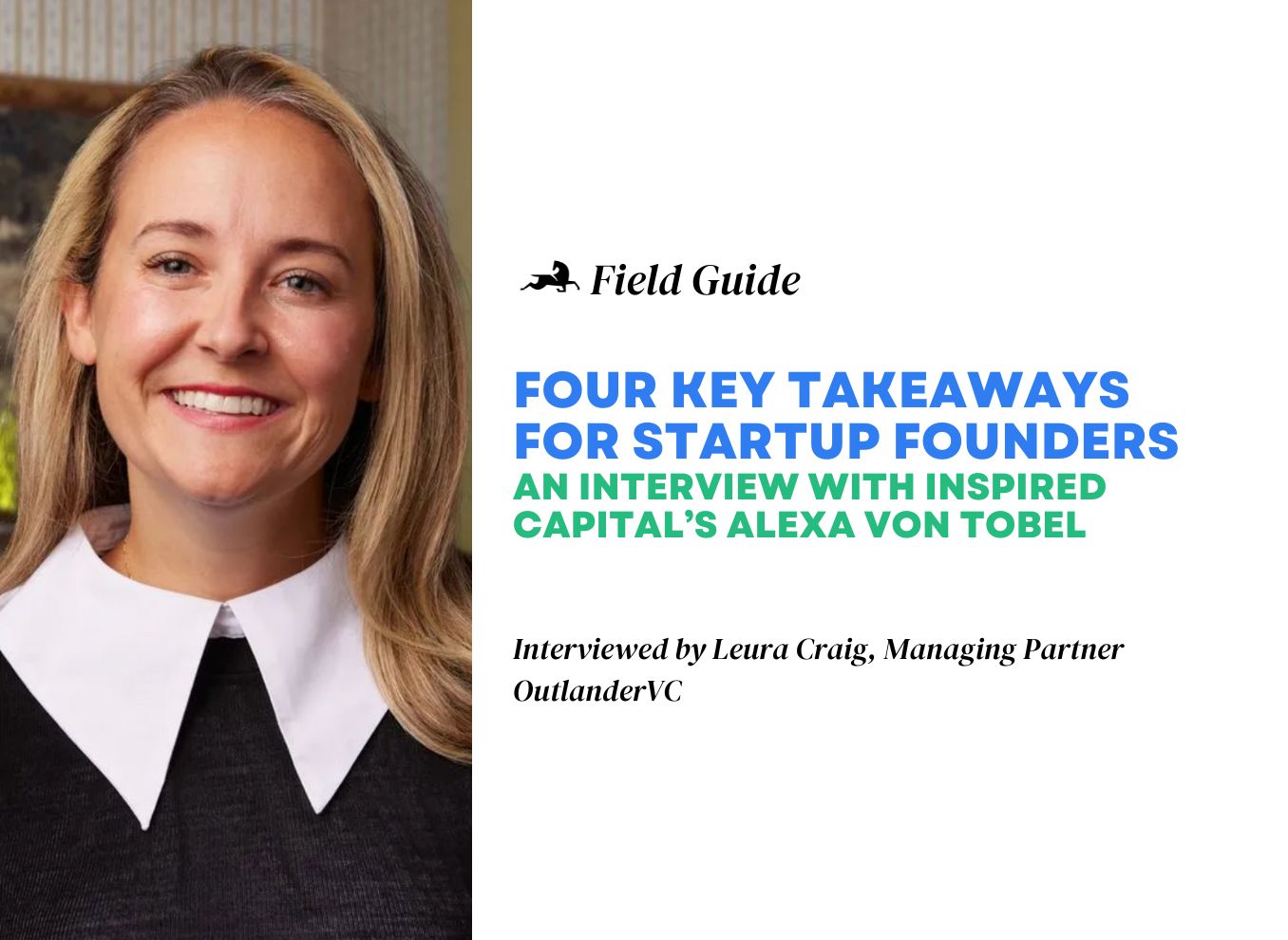

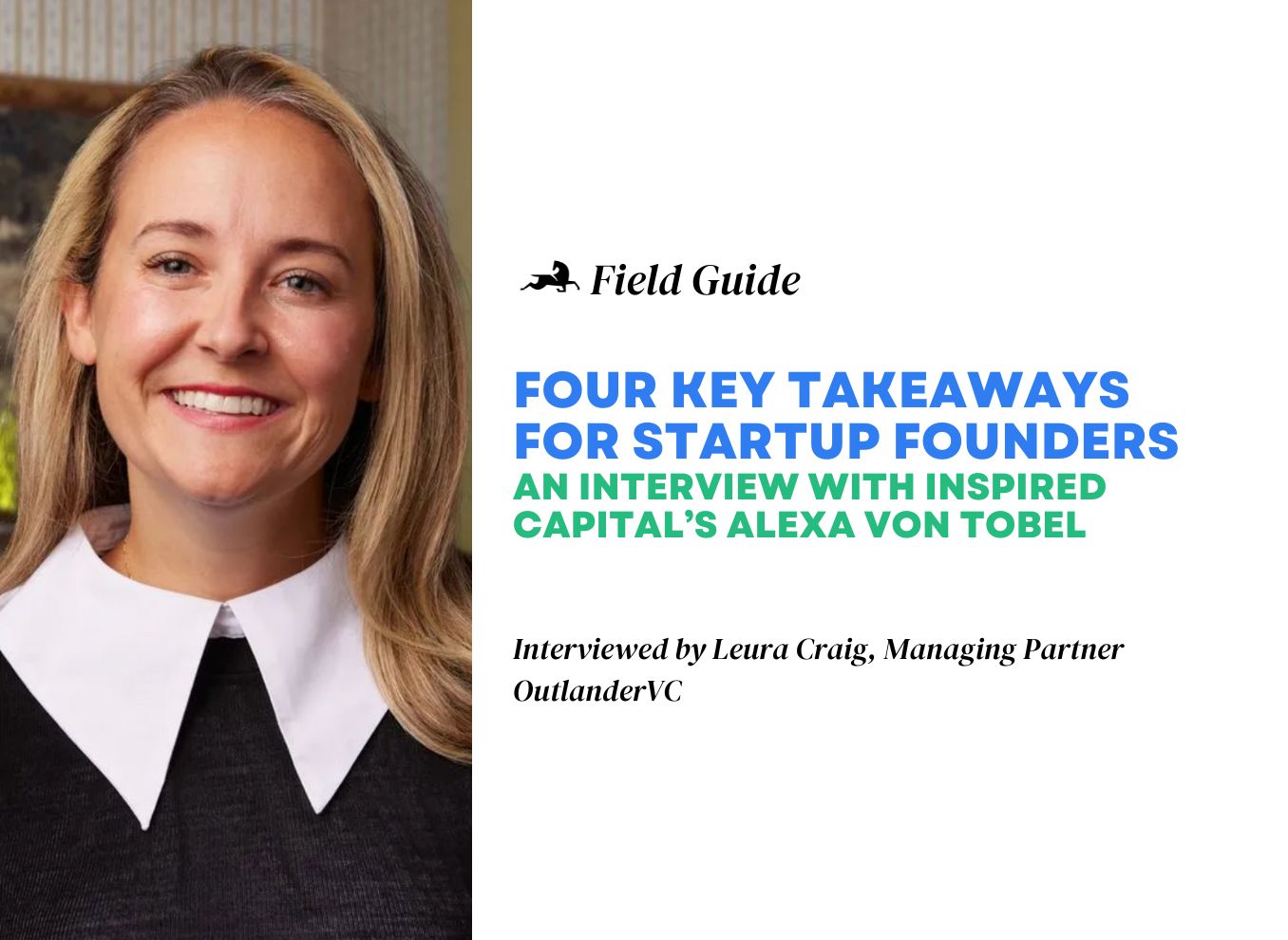

Welcome to another deep dive into the minds of venture capital leaders who are shaping the startup ecosystem. In our latest Venture Visionaries conversation, we sat down with Alexa Von Tobel, founder of Inspired Capital, to unpack her insights on what truly makes a founder—and a startup—successful.

With a background as a founder herself (LearnVest, acquired by Northwestern Mutual for nearly $400 million) and now managing almost $1 billion in investments, Alexa brings a unique perspective grounded in real-world entrepreneurial experience.

1. Obsession is the Founder’s Secret Weapon

Alexa believes the biggest pitfall for founders is building a business they don’t genuinely want to think about every day for the next 15 years. Her advice? If you’re not obsessed with the problem you’re solving, don’t start the company.

For Alexa, this personal obsession was deeply personal. After losing her father, she became passionate about democratizing financial planning—a mission that fueled LearnVest. Without that obsession, it may never have become one of the largest FinTech acquisitions of the decade.

Founder Takeaway: At Outlander, we love obsessed founders who are consumed by a problem–who see a future state that needs fixing and that you are the one to do it. Your startup should solve a problem that keeps you up at night. When the going gets tough, passion isn’t just motivational—it’s fundamental to your persistence.

2. Adaptability Over Resilience

Alexa champions adaptability. She believes the most successful founders aren’t just those who survive challenges, but those who thrive because of them.

Drawing from her podcast interviewing over 260 top founders, she’s observed a common trait: these entrepreneurs view stress as a catalyst for growth. Like Darwin’s principle of survival, it’s not the strongest who succeed, but those most adaptable to change.

Founder Takeaway: At Outlander, we love founders who have demonstrated resilience. But more important than having endured hardship is showcasing the ability to learn from it and adapt to ever-changing environments. Your ability to pivot and learn quickly may be the most valuable asset in your founder journey.

3. Capital Efficiency is Your Competitive Advantage

In today’s market, Alexa emphasizes the critical importance of being a smart capital allocator. The best founders understand that a business is essentially a machine: you put a dollar in with the expectation of generating multiple dollars in return.

She warns against unnecessary spending, especially in early stages. The most impressive founders are those who can turn on meaningful traction with minimal capital, demonstrating “scrappiness” that becomes part of the company’s DNA.

Founder Takeaway: Every dollar matters. Be strategic about resource allocation and prove you can create value with constraints.

4. The DNA of Startup Success

Alexa draws a powerful analogy from her experience founding LearnVest during the 2008 recession. Founders who start businesses during challenging times develop a different operational DNA—they learn to run at “50 miles per hour” when others might be moving at “6 miles per hour.”

This forged resilience becomes a core part of the company’s culture, creating teams that know how to operate efficiently and effectively, even when resources are limited.

Founder Takeaway: Your early-stage constraints can become your greatest strength. Embrace the challenge and let it shape your company’s culture.

Final Thoughts

Inspired Capital’s approach, much like our Founder Framework at Outlander VC, is about backing people, not just business models. It’s about finding founders who are relentless, adaptable, and deeply committed to solving meaningful problems.

For founders reading this: obsess over your mission, embrace challenges, be capital-efficient, and never stop learning. Your journey is just beginning.

Stay inspired and outlandish and, as always, be sure to pitch our team your vision at: www.outlander.vc

You can learn more about Inspired Capital at https://www.inspiredcapital.com/

Watch the full interview:

As we explore the unknown of each new investment, our Field Guides are where we document all that we learn along the way.

So, whether you’re actively raising, trying to break into VC, or interested in our game-changing portfolio, our Field Guide's got you covered.

Sign up now for exclusive access to funding opportunities, events/resources from our network of experts, updates from our portfolio, and more!