A pitch deck is a critical communications tool for all startups—it is how you tell the story of your venture, make your introductions to investors, and more. However, it doesn’t take much Googling to see that everybody’s got their own opinion of the right and wrong ways to put together a deck or how to present yourself to investors. In my experience as an investor and former founder, the most successful pitches all boil down to one major imperative: a compelling narrative arc.

When you’re speaking to a person you want to partner or work with, it’s always in your best interest to figure out the most impactful way to sell yourself, your idea, or your business to that particular person or group of people. Effective communication is all about presenting a compelling narrative, and when you’ve only got a few slides and a handful of minutes to share your startup’s story, you have to make every word count.

As with all persuasive writing, who you’re pitching to should inform your tone and diction in each iteration of your verbal pitch and every share of your deck. So, first and foremost, do some digging online to see if you can find any clues about what the investor is looking for in a pitch. It’s entirely possible that they have provided a quote for an article about what they think makes a great deck or that they’ve listed their expectations on their website. Use whatever information you can find to tailor your presentation to their most desired style of delivery without sacrificing your authenticity or personal style. It can be a tall order, but it’s worth the effort.

As more startups have learned about our upcoming pitch event, OutPitch 2021, we’ve received many questions about what we look for in a pitch deck. We really appreciate these questions because it shows that the founders not only want to understand us as investors but also recognize the importance of tailoring their message—a skill that is a boon to the long-term success of any entrepreneur and their company.

If you’ve read this far and you’re a founder interested in pitching to the Outlander team, I’ve got some good news! We’ve distilled the core features of a winning pitch, and we’re more than happy to share that information with you. Ideally, your pitch hits the ten critical highlights below in ten slides or less, leaving your audience with a well-rounded view of you, the founder, as well as the problem you’re trying to solve.

The narrative arc of a winning pitch is as follows: Start with the big picture. Then delve into the specifics and how your founding team fits in. Next, bring us up to speed on your progress thus far, then sell us on your venture’s vision for the future. In your vision for the future, be sure to demonstrate your area expertise by identifying any potential competitors or obstacles, followed by your plans to navigate around them. Conclude with your ask. And don’t forget to tailor the details to your audience!

Now you’ve got a pitch with a compelling narrative tailored to Outlander VC, and we want to see it!

Outlander is inviting the most innovative early-stage tech startups in the Southeastern United States to out-vision, outsmart, and outpitch the competition at OutPitch 2021! The live pitch competition winner will receive a $100,000 investment from Outlander VC on a $1M capped convertible promissory note! Read all of the Outpitch 2021 terms and conditions here.

If you’re the founder of an innovative early-stage tech startup headquartered in the Southeast, you are strongly encouraged to apply! The application deadline is 11:59 pm EDT on May 2nd, 2021.

The application request form is simple. Just send us your name, contact information, and the name of your startup.

Then, look out for an e-mail from info@outlanderlabs.com with the link to the full OutPitch 2021 application.

The full application consists of 14 questions, covering your contact information, co-founders, company description, location, product category, website, and pitch deck, and previous funding information.

Yay! We can’t wait to review your OutPitch application. Next, our partners will select the top six startups to pitch live to our top-tier venture capital investors and judges on May 18, 2021.

Best of luck!

To explain why our team here at Arena is so bullish on crowdfunding that we tied our model to it, I find it helpful to draw an analogy to another trend I’m passionate about: online education.

The early wave of online degrees and online universities created a stigma around online learning – people associated online degrees with a low bar for quality/prestige and with several well-known for-profit universities who didn’t have students’ best interests at heart. But the educational potential of learning online is extraordinary: data and machine learning improve students’ education in real-time and give professors magnitudes more information with which to improve courses. It can enable top universities – freed from the constraints of physical buildings – to scale their educational experience to everyone who qualifies (anywhere around the world) on a model that actually gets better the more students it includes (thanks to the amassed data).

The first startup I worked for out of college was 2U, Inc., an edtech company that is powering full online master’s degrees for top universities (Yale, Berkeley, Georgetown, USC, etc.). 2U has spearheaded the model of online higher ed that lives up to its true potential and empowers tens of thousands of students. Rather than being third-tier students, the students learning online via their platforms are full equals to peers on campus, with student IDs, campus gym access, 12-student average class size, student organizations, and class gifts to the university when they graduate. Their admissions criteria, learning outcomes, and job placement outcomes match or beat the statistics for on-campus students in the same degree programs.

Over the last couple years, crowdfunding has been making a similar shift from its early incarnations – which were not without some challenges – into a robust ecosystem capable of providing just as much value to entrepreneurs as the best alternative options (offline VC deals). While there weren’t the scandals that the education sector had to navigate, the early days of crowdfunding did raise valid concerns amongst entrepreneurs and investors. One of the biggest concerns was negative signaling associated with crowdfunding: “only people who couldn’t raise money from real investors would try this weird new crowdfunding thing”. There was a self-selection bias among the startups on the platform and the novice investors who participated – they were often participating online because they couldn’t access capital (or for investors, couldn’t access deals) elsewhere. While there were certainly exceptions – Naval Ravikant did bring other notable angels in to participate in some AngelList deals – there were systemic challenges that made crowdfunding unappealing to startups who had other funding options.

Crowdfunding campaigns, similar to Kickstarter campaigns in how they were run, took a lot of time away from the entrepreneur’s focus on running their business: campaigns necessitated cold messaging dozens (or hundreds) of random investors’ profiles, hoping their company’s profile page would “trend” and be featured on the homepage if enough investors took interest. And for all that work, a startup would get very little value from investors in return aside from the money itself. As tech investors know, money has become a commodity and the bare minimum to get into good early stage deals is to bring something else to the table that will help companies further. The challenge with a crowdfunding campaign was that not all of the participating angels offered additional value and those who did usually didn’t have a big enough ownership stake to roll up their sleeves and invest additional time/relationships into the company.

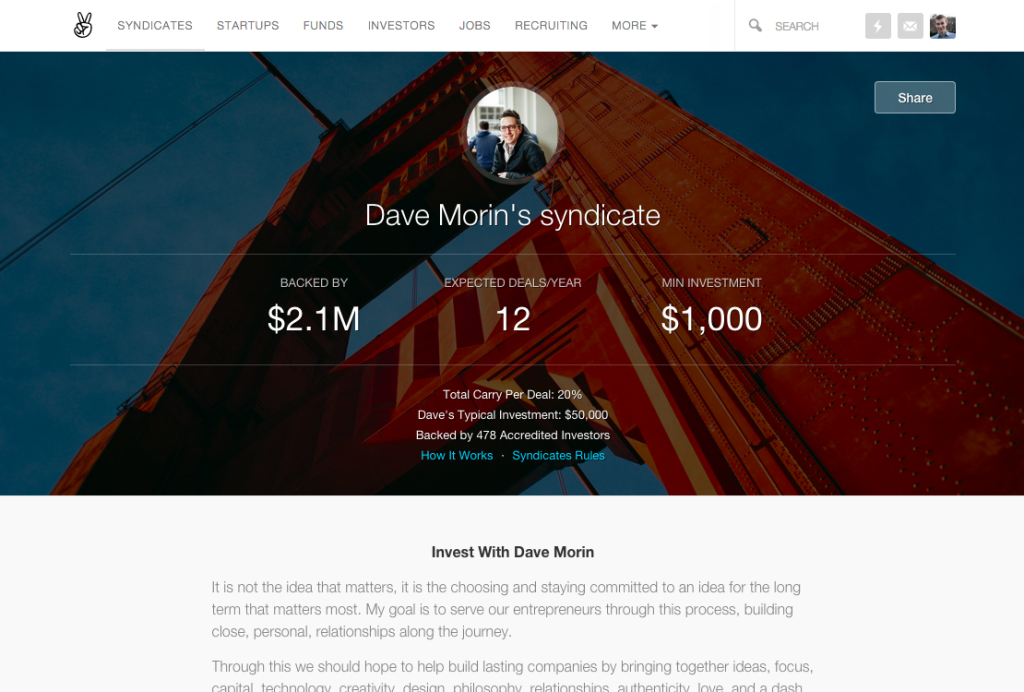

But like new models developed to bring online education into a new era, we are now in a whole new stage of crowdfunding’s evolution. There is zero question in my mind that crowdfunding in 2015 can be just as effective for entrepreneurs (and even more so) than the standard model of venture capital and angel investing. The tipping point was the launch of “syndicates” on AngelList – and now similar models on other crowdfunding platforms like Quire. Syndicates are like angel groups led by one lead investor who spearheads the sourcing and managing of deals in exchange for carry (15-20%, plus AngelList’s 5%) from the other angels who then participate with him or her. The syndicate invests in the startup as one entity and the lead investor (“syndicate lead”) acts as the one liaison, both for paperwork and for leveraging the group’s resources to help the startup with introductions, industry expertise, etc.

The syndicate model incentivizes strong investors to spearhead crowdfunding. Early hype around crowdfunding professed that online platforms would replace VC firms and professional angel investors, but that couldn’t be farther from the truth. Exceptional entrepreneurs will always want to work with exceptional investors who can help accelerate their business, and since startup investing is a “hits business,” any investor who want to see a return on their money needs to invest in the exceptional entrepreneurs. The path then for many angels is to participate in the deals of their most capable peers. Syndicates financially incentivize (on a performance basis) top investors to include others in their deals, and enable that lead investor to write much bigger checks than they alone can afford to.

Which leads me to a second critical point: good syndicate leads are bringing access to top deals that weren’t going to be on crowdfunding sites otherwise – that’s why backers are willing to pay carry (much like traditional VC Limited Partners would) to participate in deals they source. When top angels and VCs find a startup they believe can become a massive company, they inevitably want to get a large stake in it – incorporating an AngelList syndicate into their investment allows them to do that (instead of a $50,000 check they can invest $500,000 with 20% carry on the $450,000 others contributed). This creates a best of both worlds: entrepreneurs get to work with a top investor who is heavily invested in their success, and backers of the syndicate get to access deals they otherwise wouldn’t see. The entrepreneur can always tap into the contacts and experience of angels in the syndicate if they want to (part of crowdfunding’s promise) but without an obligation to interact with them if they don’t want to.

Crowdfunding syndicates aren’t displacing capable investors, they’re displacing traditional Limited Partners. For a top tier angel investor who wants to graduate into bigger checks and into leading seed rounds, the natural next step has been to raise a 10-year VC fund (with capital from family offices, endowments, and major financial institutions) – look at the rise of “micro-VC” firms. But AngelList syndicates are becoming a more flexible alternative to raising a fund: the platform handles most of the paperwork and the investor only has to do deals when they want to, incorporating the backers they want to have involved in that specific deal. Moreover, AngelList is an increasingly comprehensive financial ecosystem including multiple large fund-of-funds backing the leading syndicates in a similar way to how traditional fund-of-funds back VC firms, and including increasingly large and complex deals (like secondary investments into growth stage companies).

At Arena, we’ve built a hybrid model because it gives more flexibility to our check sizes and gives us a pool of several hundred angels from diverse background who we can tap to provide additional value-add to portfolio companies. We don’t operate our fund and our AngelList syndicate as separate firms – they are locked together and we always invest from both (which ensures neither fund LPs nor syndicate backers are ever pushed out of a great deal). For an entrepreneur, it’s just Arena investing – the fact that our capital comes from two sources doesn’t have to be any different than when a traditional VC firm invests using two funds (some remaining capital from an old fund, plus capital from their new fund). Numerous other VC firms have started incorporating crowdfunding into their investments as well, from Slow Ventures and Rothenberg Ventures on AngelList to betaworks and Index Ventures on Quire, and I’d expect numerous more to do so over the next two years.

Having to publicly share extensive internal metrics on their traction was also an early deterrent to top startups from running crowdfunding campaigns in the past, but many of the deals that syndicates do nowadays aren’t made publicly visible to all investors on AngelList. They are only made visible to approved backers of the syndicate. The syndicate lead can determine with the entrepreneur what information about the startup’s traction should and should not be shared with that group. Plus syndicates led by well-known investors – while they should always provide as much transparency to backers as possible – benefit from having a lead investor whose judgement and due diligence backers trust enough to still invest even if he/she can’t reveal much info at the request of the founder. Syndicates can even be run on an invite-only basis to control information further in the most extreme circumstances.

Crowdfunding has evolved substantially over the last half-decade and the model of AngelList syndicates has enabled it to at last go mainstream among top tier investors (and provide exceptional value to the startups and angels involved). The ecosystem to support syndicates – and the streamlined process for conducting them – becomes more robust each quarter. Over $100MM was invested over AngelList alone in 2014, and if their growth rates continue at the same pace it will be many times that within just the next couple years. The revolutionary impact of crowdfunding won’t be that it replaces professional investors, it will be that it scales the act of investing in startups and provides access to anyone around the world (who qualifies) to invest alongside the top professionals. For entrepreneurs, that’s an ideal situation: the full involvement of the same “superangels” and venture capital firms we respect now, augmented by the option to tap into an additional network of angels who are eager to help your startup if they can.

Money is all around us. We can’t get away from it. So regardless of whether you like to spend any money that you have saved away, if you like to use it to buy crypto mining equipment like the kd box goldshell to increase your funds in the future, or if you want to invest this money into something worthwhile, such as stocks and shares, or retirement funds, these are all crucial aspects that must be taken into consideration when it comes to your finances.

Once you dive into the investing world, you can quickly become buried in a tornado of potential deals or the “Dealnado,” as I call it: a swirling, twisting mass of co-investors, scammers, screaming founders, substandard deals, shiny objects, and baby unicorns buried somewhere inside the chaos.

To sort through this mess, you need a methodology to filter the gold from the dirt. Filtering is critical for any type of investing, including real estate, crypto, or startups. For example, hiring a reliable realtor you’ve worked with before is a great way to ensure you’re only shown properties with the most potential. Or, take advantage of resources like this Swyftx Review online review to ensure your first investment into Bitcoin is done on a trustworthy platform. But what about startups? How can you filter through the chaos when it comes to this type of investment?

Crafted from 7 years of angel investing and over a decade of operational experience and research into people, business, and conflict, here are five simple but critical questions I always ask before investing.

This question forces me to think about the quality of the people and the founding team’s dynamic. When I sit across from founders, I ask myself, “Would I join them?”, “Am I inspired by them?”, “Are these the brilliant, crafty leaders I can follow to glory?”. In this context, I’m not thinking like an investor or a leader but rather like a prospective early employee. I try to understand their character, values, capabilities, and passions.

A common mistake we make as investors – particularly investors who’ve previously built companies – is asking, “Could I lead this team?” or “Could I be a cofounder?” That’s the wrong approach. As investors, we can’t actually lead these teams, and we can’t make up for significant deficiencies—it’s their business, and if captains are weak, the whole ship will sink.

When I met Melody McCloskey and Dan Levine (founders of Styleseat) in 2010, I was overwhelmed by their vision, talent, and character—I couldn’t resist the impulse to work with them and invested within 48 hours. And the AngelList office could have been my home – I loved them so much that I invested in their seed and offered to join them full-time (luckily, Naval and Nivi were only hiring engineers at the time).

Since this article’s publication in 2015, question #1 has evolved into our proprietary, 38-point Outlander Founder Framework.

This is a question of your interests—do you really care about the problem they’re solving and love their solution? This is a personal question you need to answer truthfully. Many investors follow a deal because it’s “hot” (i.e., includes famous investors or is highly competitive) or because we get sucked into the hype around a broader trend (“motherf’ing BitCoin is going to disrupt everything”).

Your love for the startup matters not just for mental health but financially as well: you’ll be a better investor if you genuinely care about a startup’s solution and the space they’re disrupting. You’ll spend your spare time learning about their space, playing with their product, proactively recruiting talent, and making key introductions—all things that benefit the company and build word-of-mouth about your value as an investor.

We recently led a small pre-seed round in a company called Service that’s doing “on-demand customer service.” Aside from knowing the founder (Michael Schneider) for six years now, his approach to solving the global customer service problem from the consumer demand side felt brilliant to me. I submitted two customer service issues myself right after our first meeting – both representing about $3000 in goods – and Service solved them in no time. Companies failing to deliver on their promised experience really bugs me, and Service’s ability to smooth that over is something I want in my life. Plus, it’s a problem that hits everyone weekly, if not daily!

You’ve got to offer more than just money if you don’t want to be left on the cap-table cutting board in a competitive deal. Do you have contacts, expertise, or industry knowledge that makes your involvement matter to this team? Great deals are competitive, and great founders guard their cap tables like precious berthing. Only value-add investors get in, and if you’re not bringing something of value, you probably have little chance of getting onboard when it comes down to sorting out allocation in a round.

When you bring value to the entrepreneur in the early days of their company, however, you can directly increase the odds of them winning—and winning big. Of course, influence at the early stage doesn’t mean you get to lead the company, but you can help the company scale and get a unique edge. A great example is when James Jerlecki pitched me Mytable earlier this year: I’d been researching the concept of “crowdsourced food production” for two years and had an Evernote notebook titled “Chowtown” with over 30 companies, notes from dozens of interviews, and countless hours of research (in fact I once hired my sister to set up shop in my home and conducting pilots). So I was ready to add direct value to Mytable from day zero.

I meet many companies that fulfill the first three questions—the fourth one narrows them down a lot, though. You meet great people with interesting ideas where you can add value, and then you realize, “Damn, even if they win, I don’t think it’s going to be huge.” But, of course, this is all relative. Your definition of “major impact” and my definition may be different. I think about it in a couple of ways:

Central to this, of course, is the character and ambition of the founders – are they capable of scaling this company to the highest peaks? Generally, when I see founders primarily focused on getting acquired and making money, my interest disappears because it’s clear that they’re playing the short game and not driven by the intense need to impact the world that top founders possess.

When we discovered Honk in May of 2014 (thanks to a text from my buddy Avesta of Coloft), I realized how massive Corey’s company could be in our first meeting. Corey had almost single-handedly created one of the most unique and scalable platforms to solve the global roadside assistance problem. There was no doubt in my mind that he would disrupt towing with a solution 100x better than anything AAA or the industry had tried previously.

Timing an investment right requires a healthy knowledge of history, an insatiable curiosity for the world, and a reflective mind that thinks deeply about where the world is moving. Where are societal, economic, technological, and other trends moving, and how fast are those shifts impacting the startup’s intended market? Are you in the middle of a technology hype cycle, and is it better to wait? Is this social shift going to become more prominent over time, or is it a momentary blip? Of course, the landscape of trends that could impact a company is vast. So you have to boil each startup down to its essential elements and consider how those elements fare over the next 5 to 10 years.

For example, I’ve worked with Cy Hossain (Founder/CEO of Crowdcast) for almost 18 months as he bootstrapped the development of his new webinar platform. Existing B2B webcasting tools are outdated and don’t offer a compelling, interactive experience. However, the market’s growth and how people are adopting live-streaming video now (versus just a couple of years ago) shows we’re at an inflection point that he’ll be poised to seize.

I also dig into the founders and explore their perspectives on the timing. I want to know if they’re deliberately thinking about the network of broader trends that may impact them and how they plan to adapt if these trends play out differently.

As an individual, I need a resounding “Hell, Yes!” for each of these questions. And if I’m not excited by all five answers, I’ll pass on the deal. If you’re working in a team environment the way we operate at Outlander VC, then your grading will change to reflect your partnership. You need to be open to how your colleagues think and feel.

Of course, every investor has their own methodology that matches their unique perspective—mine comes from what I’ve seen over seven years of investing, plus my background in art, intelligence, and founding a successful defense company. Other investors will have their own questions and weigh the importance of answers differently than I do. If you’re new to investing, crafting your own method for sifting through the Dealnado is the key to efficiently finding the companies you want to bet on.