Over the years, I’ve had many opportunities to move outside the Southeast. I repeatedly heard that if I wanted to work with the brightest minds at the best organizations, I’d need to relocate. I wasn’t convinced of that logic then, and I’m not now.

I’m a Louisiana native. I moved to Atlanta for my first job after college. When I left corporate America to start my company, I had to decide where I wanted my company to be based. New York and San Francisco were on the list, but after weighing the pros and cons of all my options I decided I wanted to be in a place where I could thrive personally as well as professionally. I wanted to be somewhere I could see myself staying for the long haul (like, until I’m an old man in a rocking chair). I wanted to be in a place that felt like home. I wanted to be in the South. I decided to stay in Atlanta.

Little did I know the impact that decision would have. I had unknowingly signed up for a front-row seat at a massive transformation and tech uprising. Atlanta’s next class of great entrepreneurs were just coming into their own and a lot of them were technical. I found myself surrounded by peers who introduced me to a whole new world. They helped me, a nontechnical founder, understand how technology could make the impossible possible. I listened, learned, and incorporated it all into my company.

Fast-forward. This southern tech uprising created many high-growth companies with eight-figure revenue. Companies like BBQGUYS (nine figures), Calendly, CallRail, Fleetio, GreenLight, and LeaseQuery, to name just a few. Each a testament to the caliber of entrepreneurs who call the South home. When I look back, I’m deeply impressed by what these entrepreneurs accomplished. There wasn’t much community when most of them started out and early-stage capital was hard to come by. Yet they still managed to build amazing companies.

The community is bustling now. Accelerators, coworking spaces, conferences, and demo days are all over the South. And there are more venture funds, such as Outlander, writing checks much earlier. All of this has created a supportive and startup-friendly environment in which founders get the support and capital they need earlier so they can go further, faster. I’m optimistic about where the region is headed. I see a not-so-distant future when founders from the region turn their wildest dreams into reality and change the world. The last decade was great, but I believe it’s only a taste of what’s to come.

They say timing is everything, and that’s so true. I believe the time is now for the South to shine, and I can’t think of a better place to be. It’s wonderful to be in a place where I, along with the whole Outlander team, can help smart people build terrific companies. Doing it in a place we all love and can call home is the icing on the cake!

During the last seven years of my investing in startups, I’ve had the chance to meet a lot of really smart people with some interesting ideas. Many of them had a minimum viable product (MVP), several had only a PowerPoint, and a few had just a story to tell about the problem they wanted to solve. Some of the best investments I’ve made have come from taking a risk to back a founder who couldn’t yet “check the boxes” for what more traditional venture capitalists want to see before they will invest.

I’m so proud to have been an early supporter and investor of companies like PartPic, that struggled in the beginning to find outside investors who didn’t see the potential for this startup that made it easier to search for and order parts using computer-vision technology on their smartphone. Yet, once they had a few backers to fund an amazing founding team and their bold vision, were able to scale, grow, prove out their idea and then exit via an acquisition by Amazon in 2016. And EMRGY, a startup that delivers clean, reliable hydropower without the need for construction or dams. When I first met their founder, Emily Morris, she had a slide deck and a clear, compelling strategy for how she wanted to transform the hydropower technology space. I was immediately hooked, and made an investment, even before production started. Now, several years later, they have distributed hydropower arrays in operation across several sites in the US and have secured global distribution partnerships.

That’s why I’m so passionate about the opportunity to provide this type of early-stage funding with Outlander VC.

According to the US Business Formation Statistics (BFS), in 2019, 3.48 million applications to start a business in the US were submitted – a more than 40% growth rate from 2010. And 2020, even with the economic uncertainty triggered by COVID-19, is on pace to far exceed 2019 numbers. Through September 2020, 3.5 million new business applications were made in the US, with almost 50% of those new companies starting in the Southeast.

That’s a lot of companies needing capital to get from the idea stage to successfully launching a new product or solution in the market. Most of these companies will rely on personal savings or investments from friends and family to get started. Others will look to outside investors for their capital. But getting that outside money can be difficult at this stage of a company.

This is where Outlander VC comes in. Our mission is to be the earliest investors in the best technology startups across the Southeast.

Why early-stage? Let’s look beyond the obvious answer that early-stage startup investing offers potential for enormous growth and outsized returns relative to larger, more mature companies.

We also know that, for an early-stage company to even be considered for funding from traditional investors, they need to prove growth metrics and demonstrate the real probability of a high valuation exit. This can make it extremely difficult for early-stage companies to get the required capital to bring on the necessary resources to make it through the “Valley of Death”.

Our team at Outlander is made up of experienced investors who know how to invest in people and ideas even before they have metrics and revenue. And nothing excites us more than when we find great founders with huge ideas in a space where we can assist them in achieving their goals.

Every investment we make takes significant time, both in terms of the analysis we complete before the investment and the additional value we provide after the investment.

Why the Southeast? More than 2,300 startups call the Southeast home. Despite economic stability, a rapidly growing, diverse talent pool, and public-private emphasis on innovation, less than 7% of venture capital funding found its way into the region in the last several years.

And, as Leura Craig shared in our last blog post, we knew we could have a significant impact. In the Southeast, founders need early-stage capital, high-quality mentorship, and access to the major tech hubs to build partnerships, to find customers and, most importantly, to raise later-stage capital.

What does early-stage mean to Outlander VC? Generally speaking, it means a founding team (located in the Southeastern US) with a vision, MVP, and who has raised less than $2M in venture capital.

How do we select the companies in which we invest? We have created a proprietary founder analysis system that allows us to efficiently assess the quality of the founding team. And, through our years of experience in investing, we’ve seen that founder quality is the most important assessment factor in an early-stage deal.

Want to learn more about Outlander VC and our approach to early-stage investing, signup for our newsletter here to stay in touch with our team.

In my prior posts, I gave an overview of how entrepreneurs and investors can make the most of AngelList, the top online platform for startup investing.

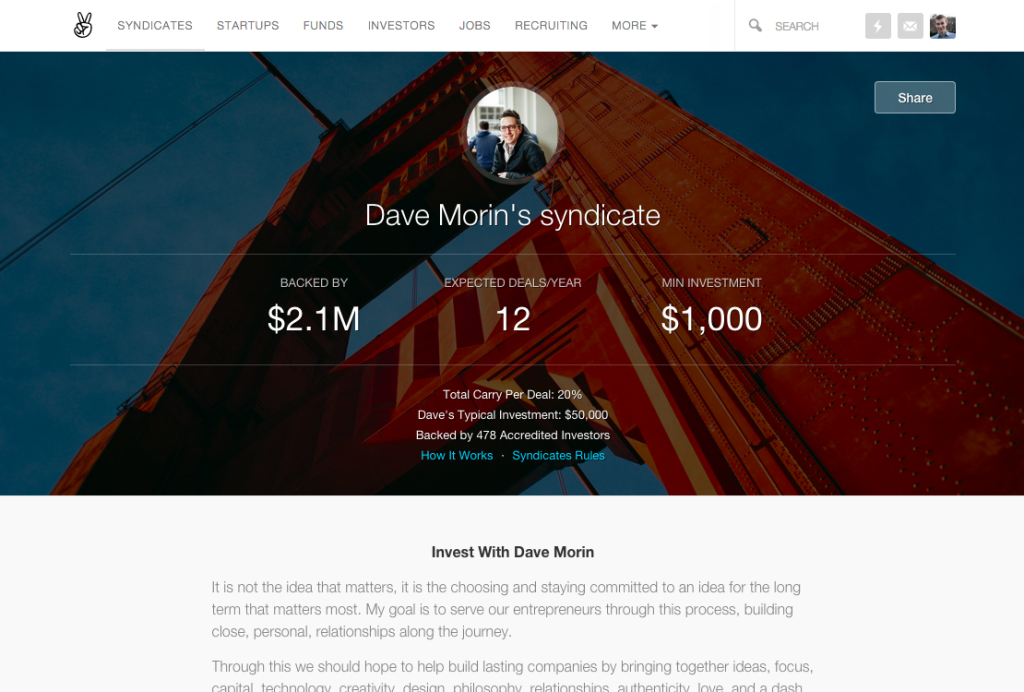

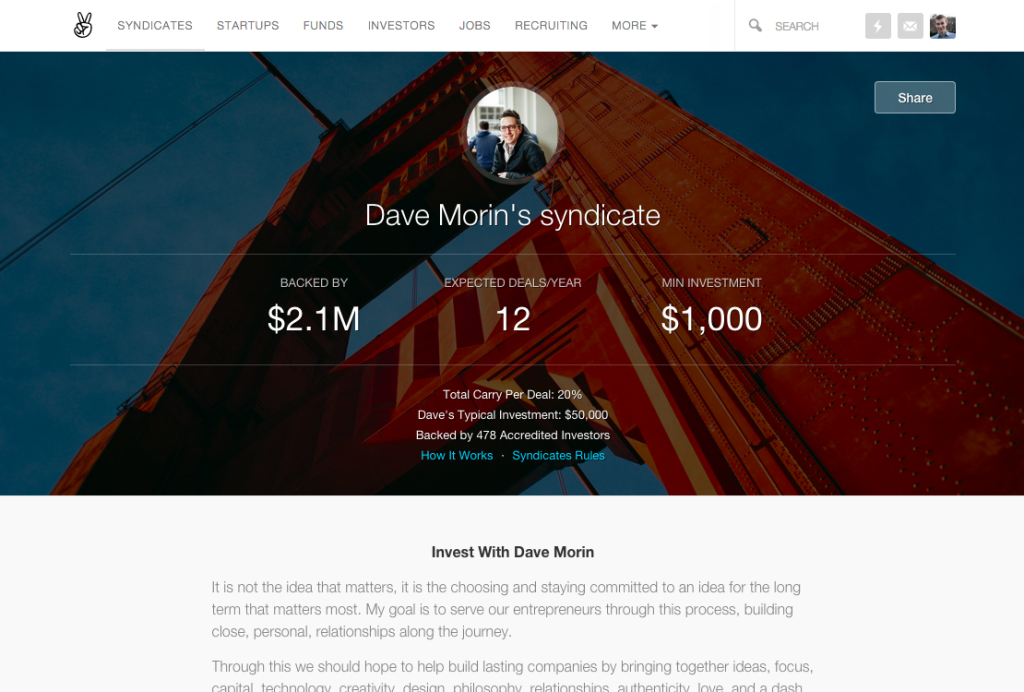

In it I recommended that both entrepreneurs and new angel investors focus on using AngelList’s syndicates as their method of accessing high-growth startup investments. A syndicate is an investment vehicle that acts like an online angel group led by one lead investor who sources and manages the deals. Investors can request to join a syndicate, see the deal flow, and either invest automatically in every deal to build a balanced portfolio or just participate in the deals they like. In exchange they pay the syndicate lead carry for having found strong deals and for being the point person who coordinates the syndicate’s interaction with the entrepreneurs they invest in.

Since the feature launched on the platform last year, syndicates have become the defacto way to invest on AngelList because the lead investors curate high-quality investment opportunities, often bringing deals to their AngelList backers that would not have appeared on AngelList otherwise (because the startup founders weren’t planning to fundraise online).

To shed more light on the rise of syndicates and what it takes to be a great syndicate lead, I reached out to David Booth who oversees syndicate operations at AngelList.

EP: What exactly is a syndicate lead and how do you become one?

DB: AngelList syndicates enable access to capital for people with high-quality deal-flow and access to high quality deals for people with capital to invest.

The individuals who find and share deals are the syndicate leads. In exchange for offering the deal up to online investors, the syndicate lead gets paid via “carried interest,” a share of any eventual profit from the investment. Leads will typically be experienced angel investors, technical founders of startups, or early hires at successful companies who may not have access to massive amounts of capital (and don’t want full-time VC roles) but who are experienced, well-connected, and excellent at recognizing talented entrepreneurs within their network.

EP: What are the expectations and responsibilities of a syndicate lead?

DB: Syndicate leads must first be experienced angel investors in their own right. Our co-founder Naval summarizes the qualities of an angel effectively: The three things that make a good angel (and thus syndicate lead) are i) access to capital, ii) high quality, proprietary deal flow and iii) good judgement.

A syndicate lead must be putting their own “skin in the game” – investing a material amount of their own capital. They are required to clearly disclose any conflict of interest or prior involvement in the companies they lead investments in, and be transparent about which deals they syndicate. The lead will act as liaison between the company and his or her backers, adding value to the company, and passing on information where appropriate. While leads don’t need to share inside information about a company with their backers, it’s best practice to keep them updated on how the company is doing, and a startup can benefit greatly from leveraging this network of stakeholders.

EP: How do you vet new syndicate leads? Do you proactively recruit people to become leads?

DB: We look for individuals with relevant experience and a proven track record as an angel investor. They might be successful founders or tech executives, VCs, or specialists in a very specific sector. We are also seeing an increasing number of VC firms using the syndicates product to run single deal funds, inviting LPs and investors from their networks to invest where they have excess pro rata rights. To date, leads have been predominantly based in the SF Bay Area, but we have started seeing an increasing number from outside Northern California.

Our team works with prospective syndicate leads well before they ever put their first deal on AngelList, helping vet opportunities and gauge which will generate interest from online investors. We also look at who they are bringing into the syndicate from their own network as backers of their syndicate; if they supposedly have good deal flow and a good network, but no one they know wants to invest with them, that’s a red flag.

EP: What differentiates the better syndicate leads in your experience?

DB: The ultimate judge of a good syndicate lead is “who is making the best returns.” However while there have been some stand-out deals on the platform, this is not easy to judge with less than 24 months of data.

One thing that is clear is that you shouldn’t judge a lead by the topline “total backing” metric alone. Some of the sharpest investors are those with great expertise in one niche who don’t share many deals or have a large following.

Regardless of syndicate size, leads who avoid adverse selection by syndicating all their deals, communicating with backers, and being transparent about why they are investing in a given company build a lot more trust and engagement from backers, and ultimately go on to lead larger, faster syndicates.

EP: What if a savvy angel investor wants access to more capital but doesn’t want to publicly announce their deals on AngelList?

DB: That’s not unusual. A significant portion of syndicates on AngelList are actually entirely private – they are run by the lead solely for the benefit of their own network, and are only visible to users who have been invited. Other leads will share deals only with their ‘funded backers,’ who store their funds on the platform and pre-commit to deals in advance. The syndicates tool serves to facilitate these private deals more efficiently (since we handle wiring of money, creation of legal documents, etc.).

EP: AngelList has several funds on the platform that selectively back certain syndicate deals. What’s their investment strategy?

DB: Yes, we have 3 funds fueled by capital from AngelList backers: the AngelList Select Fund, the AngelList Enterprise Fund, and the AngelList Consumer Fund. The funds will each invest in approximately 100+ of the most promising startups, as selected by an internal fund committee. We also have Maiden Lane, a $25M venture fund that backs a wide range of syndicates, active on the platform.

A fund gives investors the opportunity to back a diversified portfolio of startups with one investment, mitigating risk far more than could be achieved backing individual deals. The funds also get invited to private syndicates that aren’t open to the platform, so they provide access to otherwise unavailable opportunities.

EP: How are syndicates evolving as a product of AngelList?

DB: The AngelList platform has shifted over the past year from being deal-centric to lead-centric; the experience – and increasingly the product features – is about trusting the judgement of lead investors (by way of syndicates) rather than screening and picking companies to invest in entirely on your own. You’ll see that trend continue.

One goal of ours is to make it easier to match angel investors with relevant lead investors whose syndicates fit their interests and investing style. For example, if a new investor on the platform is interested in life sciences startups, we’d try to to proactively match them with some leads more specialized in that field.

EP: What are helpful resources for angels who want to become syndicate leads to determine if it’s the right fit?

DB: We have a landing page for prospective leads at https://angel.co/syndicates/start. You can also contact us for more information.

To explain why our team here at Arena is so bullish on crowdfunding that we tied our model to it, I find it helpful to draw an analogy to another trend I’m passionate about: online education.

The early wave of online degrees and online universities created a stigma around online learning – people associated online degrees with a low bar for quality/prestige and with several well-known for-profit universities who didn’t have students’ best interests at heart. But the educational potential of learning online is extraordinary: data and machine learning improve students’ education in real-time and give professors magnitudes more information with which to improve courses. It can enable top universities – freed from the constraints of physical buildings – to scale their educational experience to everyone who qualifies (anywhere around the world) on a model that actually gets better the more students it includes (thanks to the amassed data).

The first startup I worked for out of college was 2U, Inc., an edtech company that is powering full online master’s degrees for top universities (Yale, Berkeley, Georgetown, USC, etc.). 2U has spearheaded the model of online higher ed that lives up to its true potential and empowers tens of thousands of students. Rather than being third-tier students, the students learning online via their platforms are full equals to peers on campus, with student IDs, campus gym access, 12-student average class size, student organizations, and class gifts to the university when they graduate. Their admissions criteria, learning outcomes, and job placement outcomes match or beat the statistics for on-campus students in the same degree programs.

Over the last couple years, crowdfunding has been making a similar shift from its early incarnations – which were not without some challenges – into a robust ecosystem capable of providing just as much value to entrepreneurs as the best alternative options (offline VC deals). While there weren’t the scandals that the education sector had to navigate, the early days of crowdfunding did raise valid concerns amongst entrepreneurs and investors. One of the biggest concerns was negative signaling associated with crowdfunding: “only people who couldn’t raise money from real investors would try this weird new crowdfunding thing”. There was a self-selection bias among the startups on the platform and the novice investors who participated – they were often participating online because they couldn’t access capital (or for investors, couldn’t access deals) elsewhere. While there were certainly exceptions – Naval Ravikant did bring other notable angels in to participate in some AngelList deals – there were systemic challenges that made crowdfunding unappealing to startups who had other funding options.

Crowdfunding campaigns, similar to Kickstarter campaigns in how they were run, took a lot of time away from the entrepreneur’s focus on running their business: campaigns necessitated cold messaging dozens (or hundreds) of random investors’ profiles, hoping their company’s profile page would “trend” and be featured on the homepage if enough investors took interest. And for all that work, a startup would get very little value from investors in return aside from the money itself. As tech investors know, money has become a commodity and the bare minimum to get into good early stage deals is to bring something else to the table that will help companies further. The challenge with a crowdfunding campaign was that not all of the participating angels offered additional value and those who did usually didn’t have a big enough ownership stake to roll up their sleeves and invest additional time/relationships into the company.

But like new models developed to bring online education into a new era, we are now in a whole new stage of crowdfunding’s evolution. There is zero question in my mind that crowdfunding in 2015 can be just as effective for entrepreneurs (and even more so) than the standard model of venture capital and angel investing. The tipping point was the launch of “syndicates” on AngelList – and now similar models on other crowdfunding platforms like Quire. Syndicates are like angel groups led by one lead investor who spearheads the sourcing and managing of deals in exchange for carry (15-20%, plus AngelList’s 5%) from the other angels who then participate with him or her. The syndicate invests in the startup as one entity and the lead investor (“syndicate lead”) acts as the one liaison, both for paperwork and for leveraging the group’s resources to help the startup with introductions, industry expertise, etc.

The syndicate model incentivizes strong investors to spearhead crowdfunding. Early hype around crowdfunding professed that online platforms would replace VC firms and professional angel investors, but that couldn’t be farther from the truth. Exceptional entrepreneurs will always want to work with exceptional investors who can help accelerate their business, and since startup investing is a “hits business,” any investor who want to see a return on their money needs to invest in the exceptional entrepreneurs. The path then for many angels is to participate in the deals of their most capable peers. Syndicates financially incentivize (on a performance basis) top investors to include others in their deals, and enable that lead investor to write much bigger checks than they alone can afford to.

Which leads me to a second critical point: good syndicate leads are bringing access to top deals that weren’t going to be on crowdfunding sites otherwise – that’s why backers are willing to pay carry (much like traditional VC Limited Partners would) to participate in deals they source. When top angels and VCs find a startup they believe can become a massive company, they inevitably want to get a large stake in it – incorporating an AngelList syndicate into their investment allows them to do that (instead of a $50,000 check they can invest $500,000 with 20% carry on the $450,000 others contributed). This creates a best of both worlds: entrepreneurs get to work with a top investor who is heavily invested in their success, and backers of the syndicate get to access deals they otherwise wouldn’t see. The entrepreneur can always tap into the contacts and experience of angels in the syndicate if they want to (part of crowdfunding’s promise) but without an obligation to interact with them if they don’t want to.

Crowdfunding syndicates aren’t displacing capable investors, they’re displacing traditional Limited Partners. For a top tier angel investor who wants to graduate into bigger checks and into leading seed rounds, the natural next step has been to raise a 10-year VC fund (with capital from family offices, endowments, and major financial institutions) – look at the rise of “micro-VC” firms. But AngelList syndicates are becoming a more flexible alternative to raising a fund: the platform handles most of the paperwork and the investor only has to do deals when they want to, incorporating the backers they want to have involved in that specific deal. Moreover, AngelList is an increasingly comprehensive financial ecosystem including multiple large fund-of-funds backing the leading syndicates in a similar way to how traditional fund-of-funds back VC firms, and including increasingly large and complex deals (like secondary investments into growth stage companies).

At Arena, we’ve built a hybrid model because it gives more flexibility to our check sizes and gives us a pool of several hundred angels from diverse background who we can tap to provide additional value-add to portfolio companies. We don’t operate our fund and our AngelList syndicate as separate firms – they are locked together and we always invest from both (which ensures neither fund LPs nor syndicate backers are ever pushed out of a great deal). For an entrepreneur, it’s just Arena investing – the fact that our capital comes from two sources doesn’t have to be any different than when a traditional VC firm invests using two funds (some remaining capital from an old fund, plus capital from their new fund). Numerous other VC firms have started incorporating crowdfunding into their investments as well, from Slow Ventures and Rothenberg Ventures on AngelList to betaworks and Index Ventures on Quire, and I’d expect numerous more to do so over the next two years.

Having to publicly share extensive internal metrics on their traction was also an early deterrent to top startups from running crowdfunding campaigns in the past, but many of the deals that syndicates do nowadays aren’t made publicly visible to all investors on AngelList. They are only made visible to approved backers of the syndicate. The syndicate lead can determine with the entrepreneur what information about the startup’s traction should and should not be shared with that group. Plus syndicates led by well-known investors – while they should always provide as much transparency to backers as possible – benefit from having a lead investor whose judgement and due diligence backers trust enough to still invest even if he/she can’t reveal much info at the request of the founder. Syndicates can even be run on an invite-only basis to control information further in the most extreme circumstances.

Crowdfunding has evolved substantially over the last half-decade and the model of AngelList syndicates has enabled it to at last go mainstream among top tier investors (and provide exceptional value to the startups and angels involved). The ecosystem to support syndicates – and the streamlined process for conducting them – becomes more robust each quarter. Over $100MM was invested over AngelList alone in 2014, and if their growth rates continue at the same pace it will be many times that within just the next couple years. The revolutionary impact of crowdfunding won’t be that it replaces professional investors, it will be that it scales the act of investing in startups and provides access to anyone around the world (who qualifies) to invest alongside the top professionals. For entrepreneurs, that’s an ideal situation: the full involvement of the same “superangels” and venture capital firms we respect now, augmented by the option to tap into an additional network of angels who are eager to help your startup if they can.

One of the biggest trends in tech and finance over the last decade has been the rise of equity crowdfunding platforms that enable investors from around the world to find and invest in privately-held companies. For companies, this provides a whole new financing source where founders can promote themselves and receive investments from investors outside of their networks. Crowdfunding democratizes investing by allowing small investors to pool their capital into one large investment, accessing opportunities they couldn’t tap into on their own.

Among startup-focused crowdfunding platforms, AngelList was the early leader and remains at the head of the pack. In 2014, they processed over $100MM in investments…and this is still the early days. Equity crowdfunding is moving into every sphere of finance from real estate to hedge funds and is predicted to surpass $30B this year globally.

AngelList originally started as an email newsletter that founder Naval Ravikant sent to fellow angel investors in San Francisco to share the new startups he found most compelling. In time, that newsletter evolved into a platform where anyone can share what they are investing in, browse the profiles of new startups, and make their investments on the spot.

Our unique model as a venture capital firm that shares every deal on AngelList results in us fielding a lot of questions from entrepreneurs and angels about how to make the most of the platform, so here is my advice:

Nowadays there are thousands of startups with profiles on AngelList. Sticking out among the noise requires you to make a strong first impression in the few seconds that an investor skims over your profile – you need to hook them. Take the time to fill out your full company profile (and your team’s personal profiles) and to think about the story you’re pitching to investors. Include recommendations as well as media like your pitch deck, product screenshots, and ideally a well-produced 1-2 minute video that concisely shows your team, product, and vision. Dustin Dolginow of Maiden Lane wrote a helpful 3-part series on how to craft a great AngelList profile that you can use for guidance.

View equity crowdfunding as a tool you use in addition to traditional fundraising offline. If you’re planning to fundraise on AngelList, lock up firm commitments from several angel investors offline before you begin publicly fundraising on the platform. Like donation-based crowdfunding campaigns on Kickstarter, you want to seed your fundraising campaign with an initial base of backers on Day One. Those first backers lend needed social credibility to other investors that view your profile – an investor who has never met you wants to know that at least others in the deal have vetted you more in-depth. Moreover, their backing on the first day of your fundraise gives the campaign momentum, which can make your company “trend” on the site, generating greater interest and giving prospective backers a fear of missing out if they don’t act quickly. (Justin Thiele sheds light on how to trend on AngelList here.)

We strongly advise entrepreneurs to raise capital on AngelList through a vehicle called a “Syndicate,” however. Syndicates are like online angel groups who back deals led by their one lead investor (to whom they pay carry for sourcing and managing the deals). For an entrepreneur, having one lead investor who rallies other backers and handles the logistics of the transaction results in a much more time-efficient process. The syndicate acts as one entity on the cap table, with one person serving as the liaison and handling all paperwork. Crowdfunding via a syndicate lead gives you the best of both worlds: access to the angels that crowdfunded the syndicate but not the requirement to directly deal with each of them if you don’t want to. Make sure you go with a syndicate lead who knows what they’re doing and is committed to the responsibilities they’re taking on, however. (Also make sure the size of their syndicate is more than enough to cover the amount to expect to raise from them.)

For those getting into angel investing, AngelList is an incredible tool: it allows you to find and invest in exceptional start ups without needing to be a Silicon Valley insider. You can easily sort through the profiles of every startup on the platform, view their story / team / early traction, and look at who else is backing them. One of the most helpful functions of AngelList for new investors is the ability to follow notable angels’ investing activity and start understanding the types of startups they back and people they invest alongside. Learn, in part, by watching the best.

Much like how AngelList’s syndicates are the most efficient model for entrepreneurs raising equity crowdfunding, syndicates are an important resource to investors as well. While a new angel has the money to invest and perhaps a background working in tech, they don’t yet have a track record of angel investments that they’ve learned from. Picking out the winners at their seed stage is incredibly difficult. To make up for their inexperience and lack of a large personal brand in the investor community, they can back syndicates led by more experienced investors in order to access their deal flow (which leads to higher returns). Typically syndicate leads are professional or semi-professional angel investors that hunt for deals around the clock and bring their syndicate opportunities that weren’t appearing on AngelList otherwise. Expect them to share their full, detailed analysis of each startup so you have the information to make your own judgement call (and be wary of those who don’t provide much information).

Best of all, you can back as many syndicates as you want without a commitment to invest alongside them. You’re asked to “back” the syndicate for an amount in order to convey the check size you would write if you decide to participate in a deal, but there’s no commitment to do so. To maximize your deal flow, back the syndicates of several people whose judgement you trust. Many syndicate leads never make their active deals public to those who don’t back their syndicate, so you’re missing out if you don’t back any. Angel investing / venture capital is a “hits business” where you make all your money from your few big wins, so you want to optimize your likelihood of backing one of those winners.

If you are comfortable committing capital to a certain syndicate (putting capital in escrow that is required to be invested through that syndicate), you have the option to do so as a “Pre-Funded Backer.” Some syndicates (ours included) give Pre-Funded Backers early access to their deals and guarantee them allocation. A Pre-Funded Backer can spread money across every deal the syndicate does or can opt-out of some in order to invest more heavily in others. You do pay carry to syndicate leads (15-20%, plus 5% for AngelList), but in a good syndicate, the deals are considerably higher quality than what a new investor is likely to come across on their own.

AngelList profiles, by the way, matter for angel investors too. When you back a deal or request to become a Pre-Funded Backer of a syndicate, the entrepreneur and syndicate lead (respectively) get to decide whether or not to accept your money. In competitive deals, the entrepreneur doesn’t necessarily have the space on the cap table to accept every check, so you want your profile to show off who you are and what value you can add to companies. With a compelling your profile, you will also be more likely to benefit from the social aspect of AngelList – organically building a following of entrepreneurs and fellow investors that you can tap into for sourcing deals or for bringing them in as co-investors into a deal of your own.

When you make full use of it, AngelList is a powerful platform for raising capital and investing in new, high-growth-potential companies. It’s a global marketplace where the best entrepreneurial ventures can get funded, and it continues to evolve every month for the better.